Local Market Update – May 2021

A sizeable increase in new listings in April offered some good news for buyers, but it was matched by an even greater increase in sales. With supplies depleted, and homes being snapped up within days, nearly every area saw double-digit price gains. The current forecast as we head towards summer: the market remains as hot as ever.

Despite the influx of new listings, inventory in the region remains one of the tightest in the country. At the end of the month there were 43% fewer homes on the market in King County than there were a year ago. Snohomish County had 49% less inventory, and has just 519 single-family homes for sale in the entire county. There were only 309 homes for sale on the Eastside, which stretches from Renton to Woodinville. Demand is so outstripping supply that 95% of the homes that sold last month on the Eastside sold within two weeks. In Seattle that number was 84%.

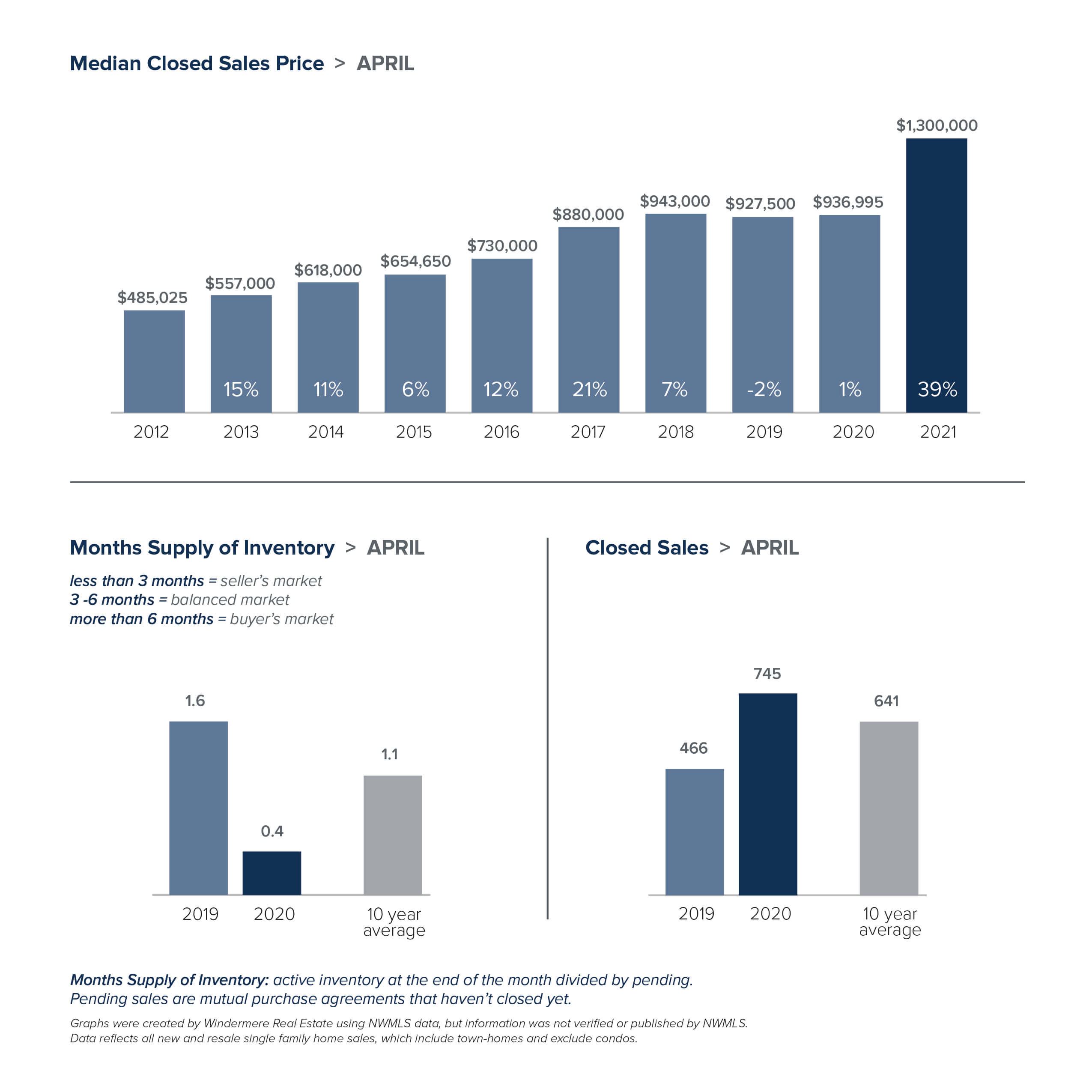

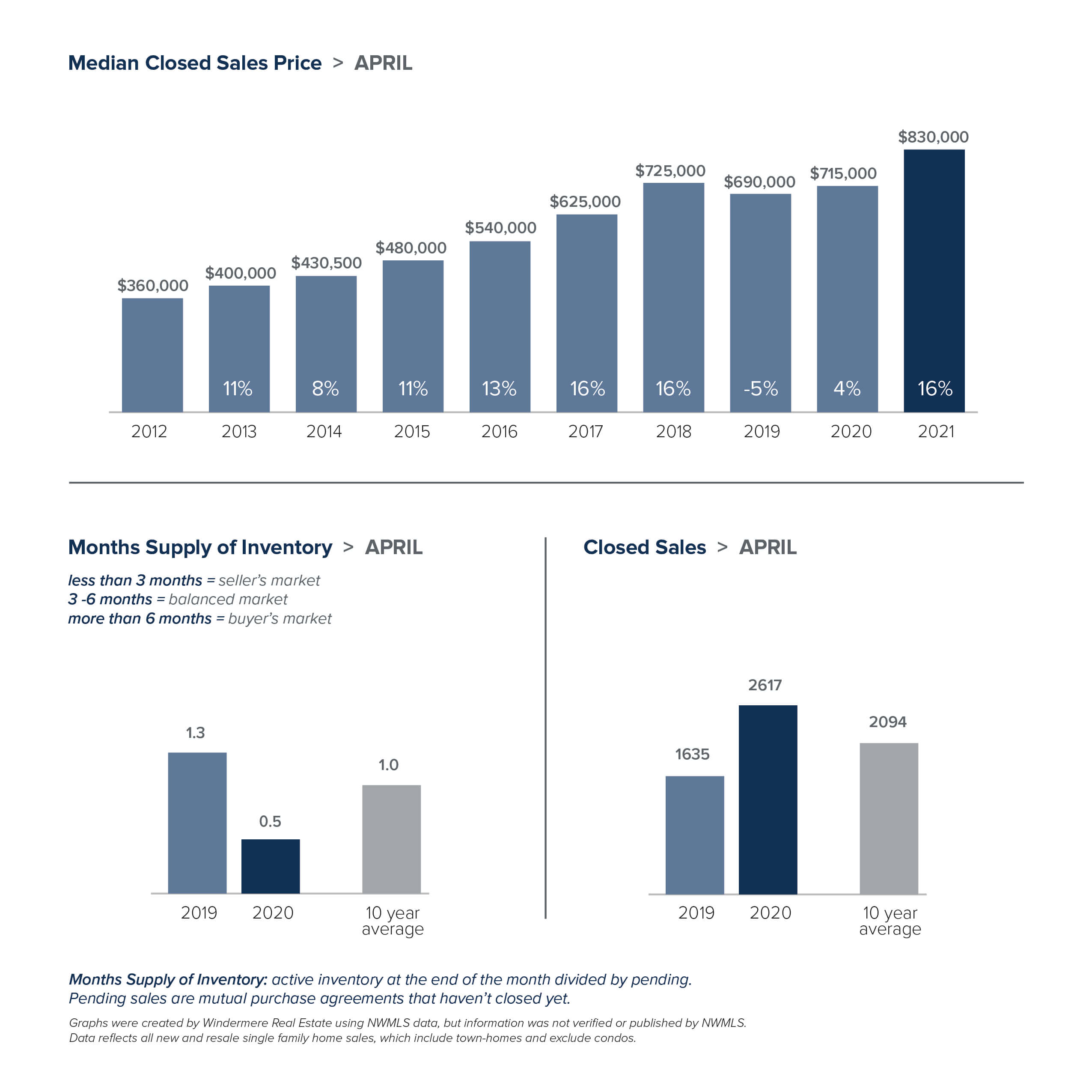

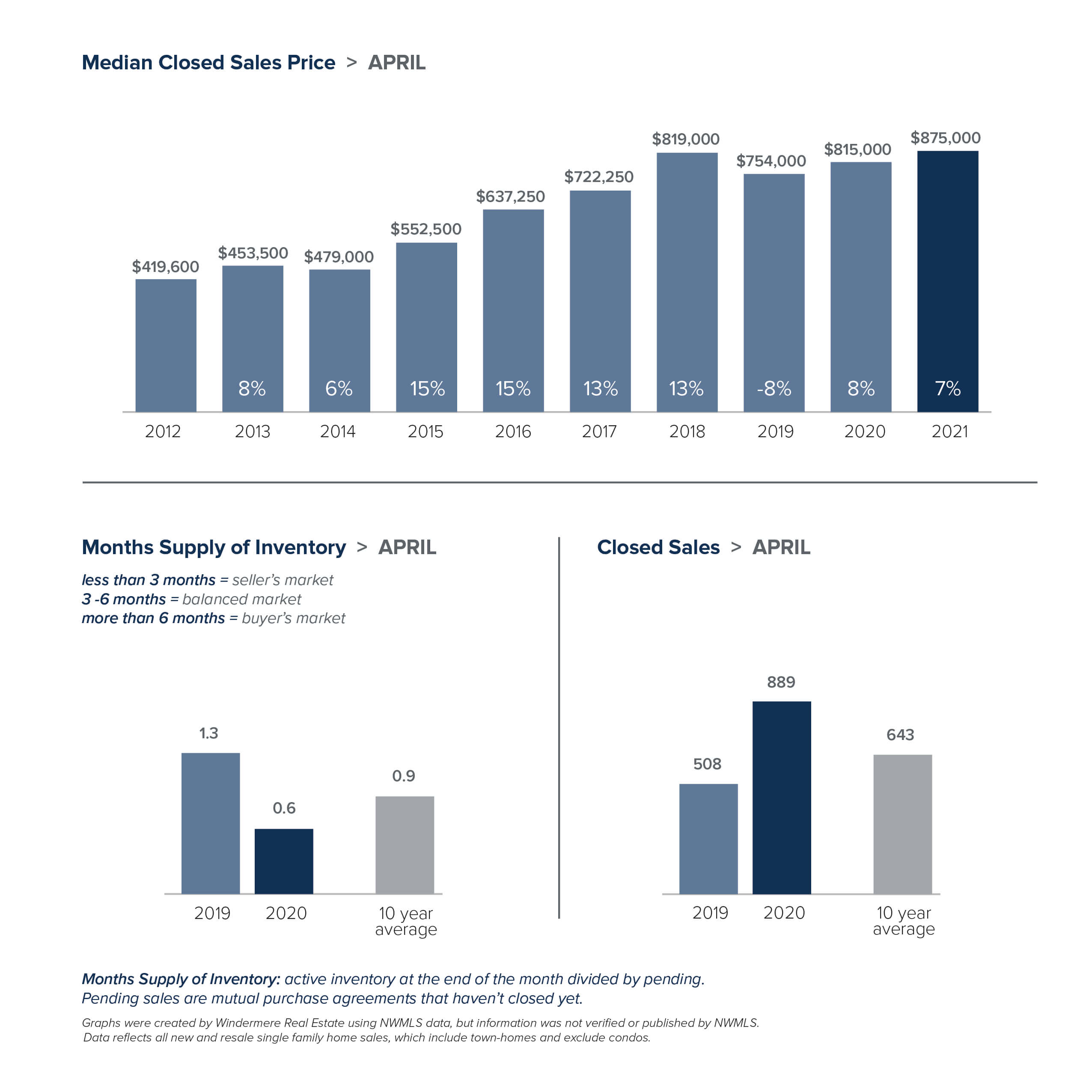

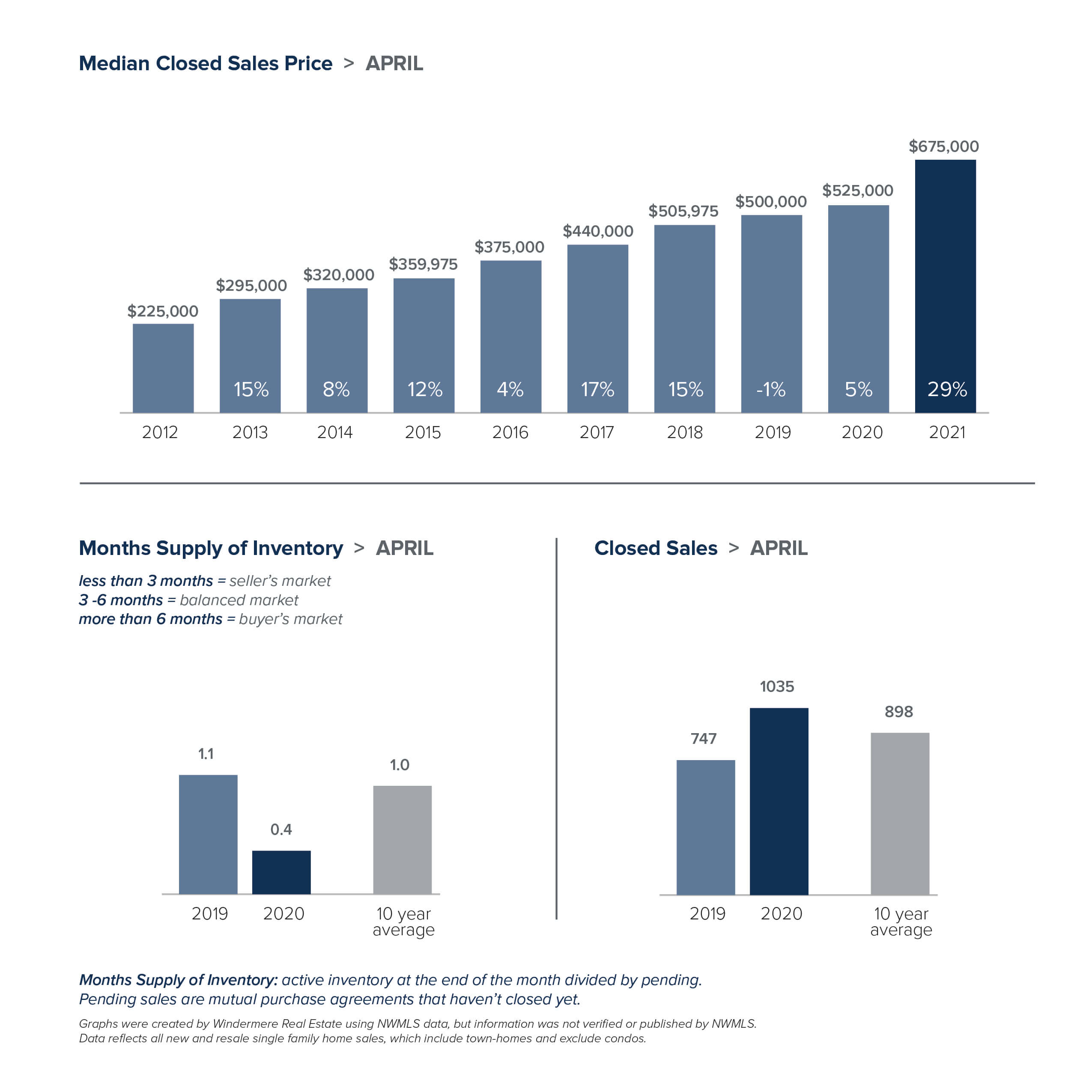

Home prices hit record highs in April, with nearly every area seeing double-digit price increases. The median price of a single-family home in King County last month was $830,000. Snohomish County’s median price soared to $675,000. Seattle’s median home price hit $875,000. All were new records. At $1.3 million, the median price on the Eastside was down slightly from its all-time high in March, but up a whopping 39% from the same time last year. In another show of the strength of the market, 82% of homes on the Eastside sold for over the list price. That compares with 60% of homes in Seattle. The Seattle market remains strong, however price appreciation there has slowed relative to other areas of King County and inventory has crept up. Condos present one bright spot for buyers. Price growth has been slower and inventory has been higher than for single-family homes. The $460,000 median price for a condo in King County is 45% less than the median price of a single-family home there.

Needless to say, this is a challenging market for buyers. With multiple offers and escalation clauses the norm, it’s critical to work with your broker on a plan to consider all possible scenarios when looking to buy a home. If you’re thinking about selling, it’s an ideal time to get a maximum return on your property before the prospect of rising interest rates starts to moderate the market.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GettheWReport.com

Windermere Foundation Has Raised over $825,000 This Year!

Image source: Shutterstock

The first half of 2020 has brought uncertain times and unprecedented change, and across our network, our agents and offices have rallied with their communities through the challenges of the COVID-19 pandemic. We’ve seen offices come together in support of their neighbors by providing meals to frontline workers, donating to local food banks, and giving their time in support of low-income and homeless families impacted by COVID-19. So far this year, we’ve raised over $825,000, with over $500,000 coming in second quarter alone, bringing the total raised by the Windermere Foundation to $41.8 million.

Here’s how some of our offices have served their communities during the COVID-19 pandemic:

Sedro Woolley & Mount Vernon, WA

Over the course of the first half of the year, the Windermere Sedro Woolley and Windermere Mount Vernon offices have donated more than $5,000 combined to the Helping Hands Food Bank to help their mission of providing local families with healthy meals through the pandemic.

Gearhart & Cannon Beach, OR (Windermere Realty Trust)

In a joint effort through Windermere Realty Trust, the Oregon Coast offices of Cannon Beach and Gearhart raised $2,000 for the organization Food 4 Kids. Food 4 Kids’ goal is to supply elementary and middle school students in the Seaside School District with supplementary weekend meals during the school year, currently feeding 235 children.

Penrith Home Loans

Earlier this year, Windermere’s mortgage partner, Penrith Home Loans, donated a total of $12,000 to the Windermere Foundation.

“The Windermere Foundation’s dedication to supporting low-income and homeless families in our communities aligns with the personal values of the employees who make up Penrith Home Loans,” said Maya Dartiguenave, Marketing Manager at Penrith Home Loans.

Penrith’s donations supported the organizations Hopelink and Share Vancouver. Hopelink was chosen by Penrith because of their holistic approach to helping people out of poverty and its mission “to promote self-sufficiency for all members of our community.” Share Vancouver was chosen because of its commitment to making Vancouver, Washington a home for everyone in the community. Examples of their work include employing an outreach team directly on the streets of Vancouver, providing emergency shelters, offering free meals to hungry children and subsidized housing to low-income families.

Neighbors in Need

Between April 21 and May 5, the entire Windermere network came together to support local food banks through our Neighbors in Need fundraising campaign. Offices were challenged to raise $250,000, to be matched by the Windermere Foundation, for a total goal of $500,000. While coping with increased demand and a bottlenecked pipeline of food supply due to COVID-19, food banks were—and continue to be—desperate for funds to continue to serve those in need. Neighbors in Need surpassed the original goal of $500,000, raising a total of $690,000, and helping hundreds of food banks.

“I’m incredibly proud of how our offices and the community came together to raise much needed money and awareness to help food banks keep up with unprecedented needs,” said Windermere Foundation Executive Director, Christine Wood. “I hope we inspire others to do the same.”

These are just a few examples of how the donations flowing through the Windermere Foundation propel us forward in our mission to support low-income and homeless families in the communities across the Western U.S. If you’d like to help support organizations and programs in your community, please click the Donate button.

To learn more about the Windermere Foundation, visit WindermereFoundation.com.

This post originally appeared on the Windermere.com Blog

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.