Local Market Update – April 2021

Despite a bump in new listings the supply of homes still can’t keep up with the demand. The result? Multiple offers, escalation clauses, and record-breaking prices. If you’re considering selling your home, you’d be hard pressed to find a more lucrative market than what we have today.

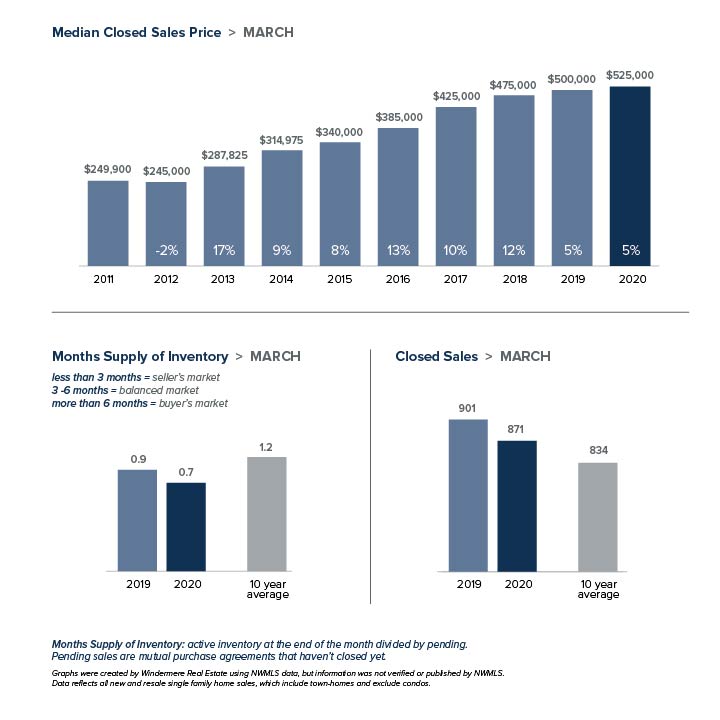

March marked the first post-COVID/pre-COVID comparison, and the results were dramatic.

The drop in the number of listings was profound. In King County there were 54% fewer single-family homes on the market at the end of March than the same time a year ago. The Eastside had 68% fewer listings. There were just 216 homes for sale on the Eastside, which stretches from Issaquah to Woodinville. Extensive new investments there, including Amazon’s plan to add 25,000 jobs in Bellevue, will only increase demand for housing. North King County, which includes Richmond Beach and Lake Forest Park had just 26 homes for sale. In Seattle, the 498 listings there represents a drop of 18% from a year ago. Despite the comparatively greater number of listings, Seattle still has only two weeks of available inventory. The situation was even more dire in Snohomish County. With the number of homes for sale down 68%, the county has just one week of inventory.

So why is inventory so low? The pandemic certainly has played a part. People now working from home have bought up properties with more space in more desirable locations. Nervousness and uncertainty about COVID compelled many would-be sellers to postpone putting their home on the market. Downsizers who may have moved into assisted living or nursing homes are staying in place instead. But there are other factors as well.

For more than a decade, less new construction has been built relative to historical averages, particularly in the suburbs. Interest rates have also been a factor. Windermere Chief Economist Matthew Gardner noted, “I think a lot of the urgency from buyers is due to rising mortgage rates and the fear that rates are very unlikely to drop again as we move through the year, which is a safe assumption to make.” Homeowners who refinanced when rates were at record lows are staying in their homes longer, keeping more inventory off the market. And those same low interest rates have compelled many homeowners who bought a new home not to sell their previous one, but to keep it as a rental property.

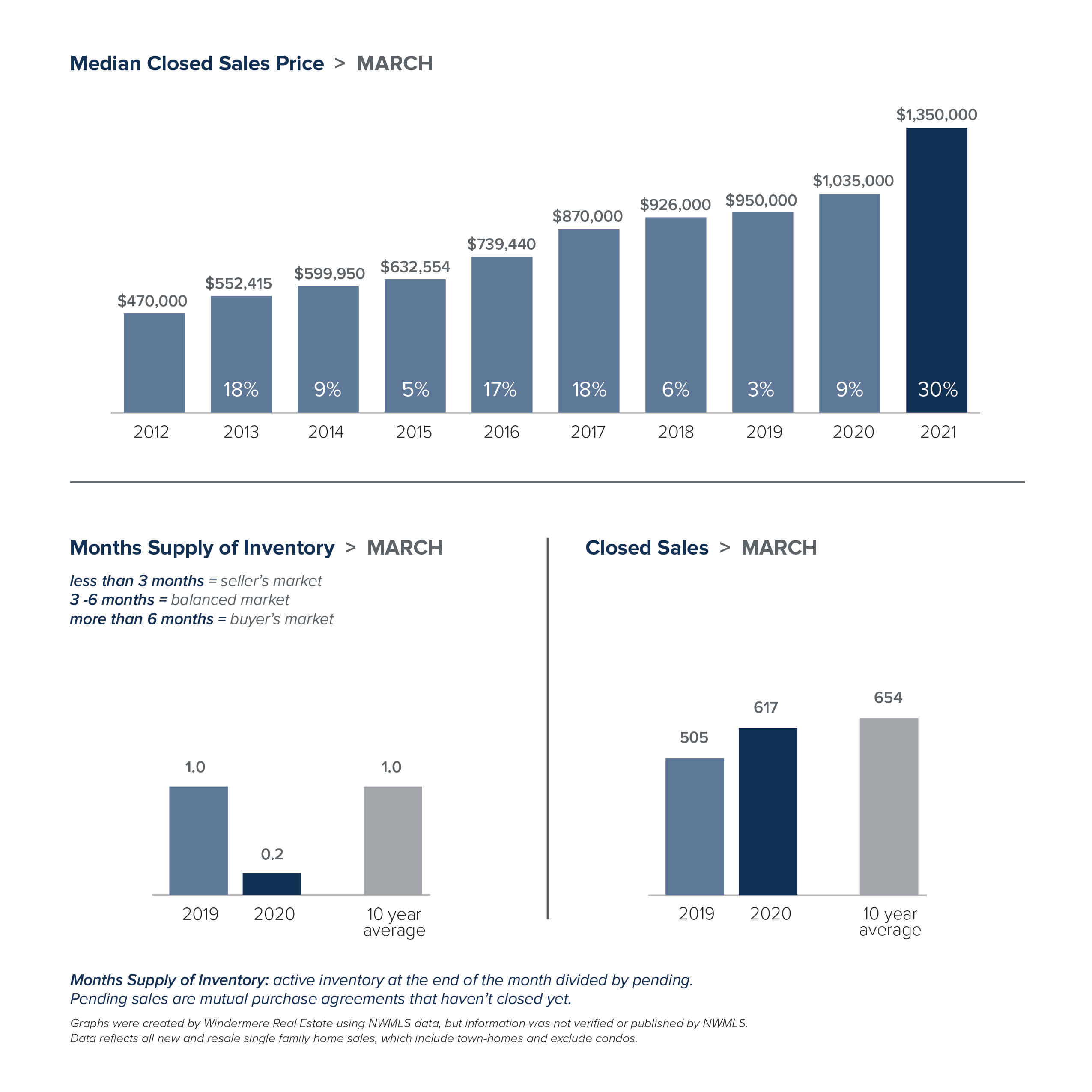

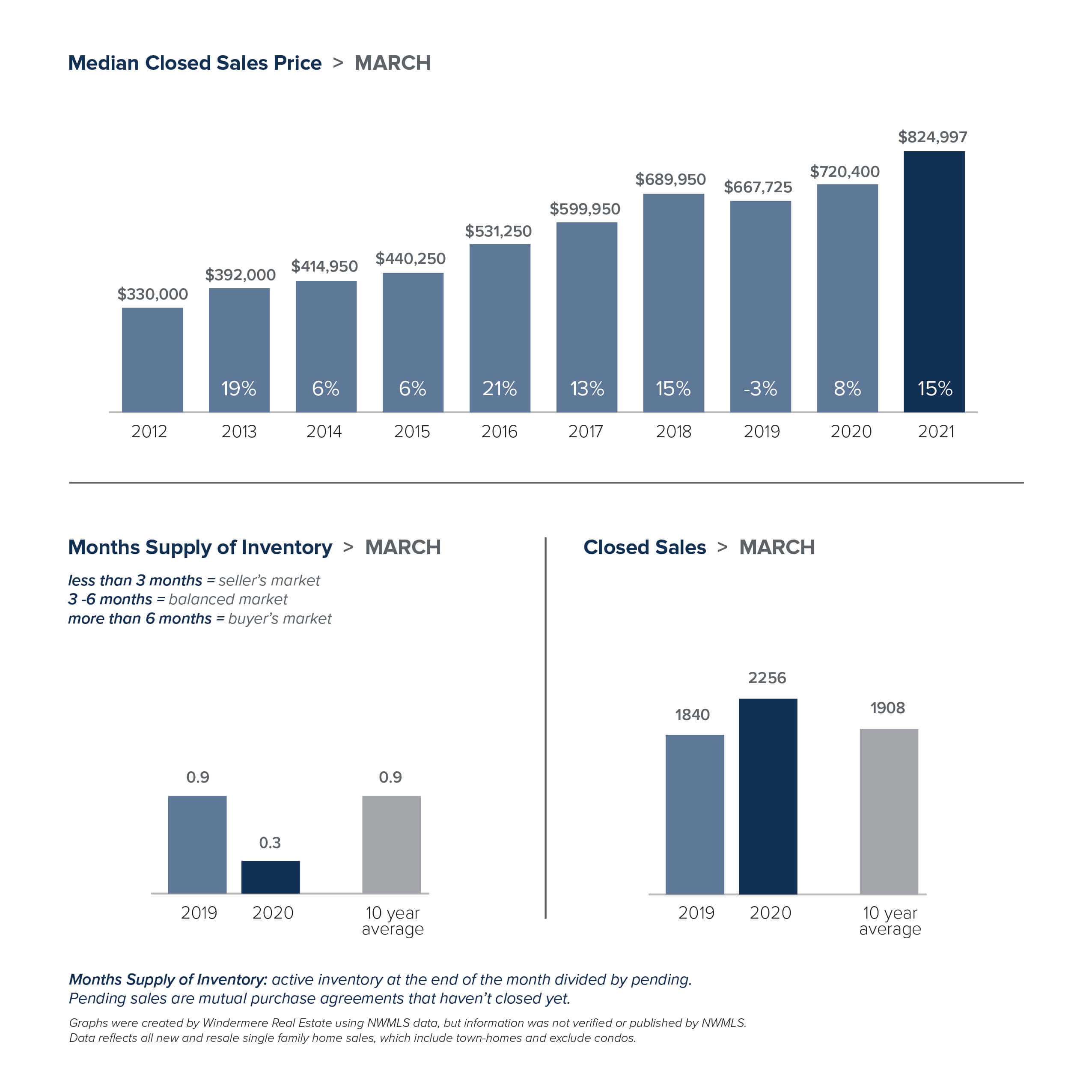

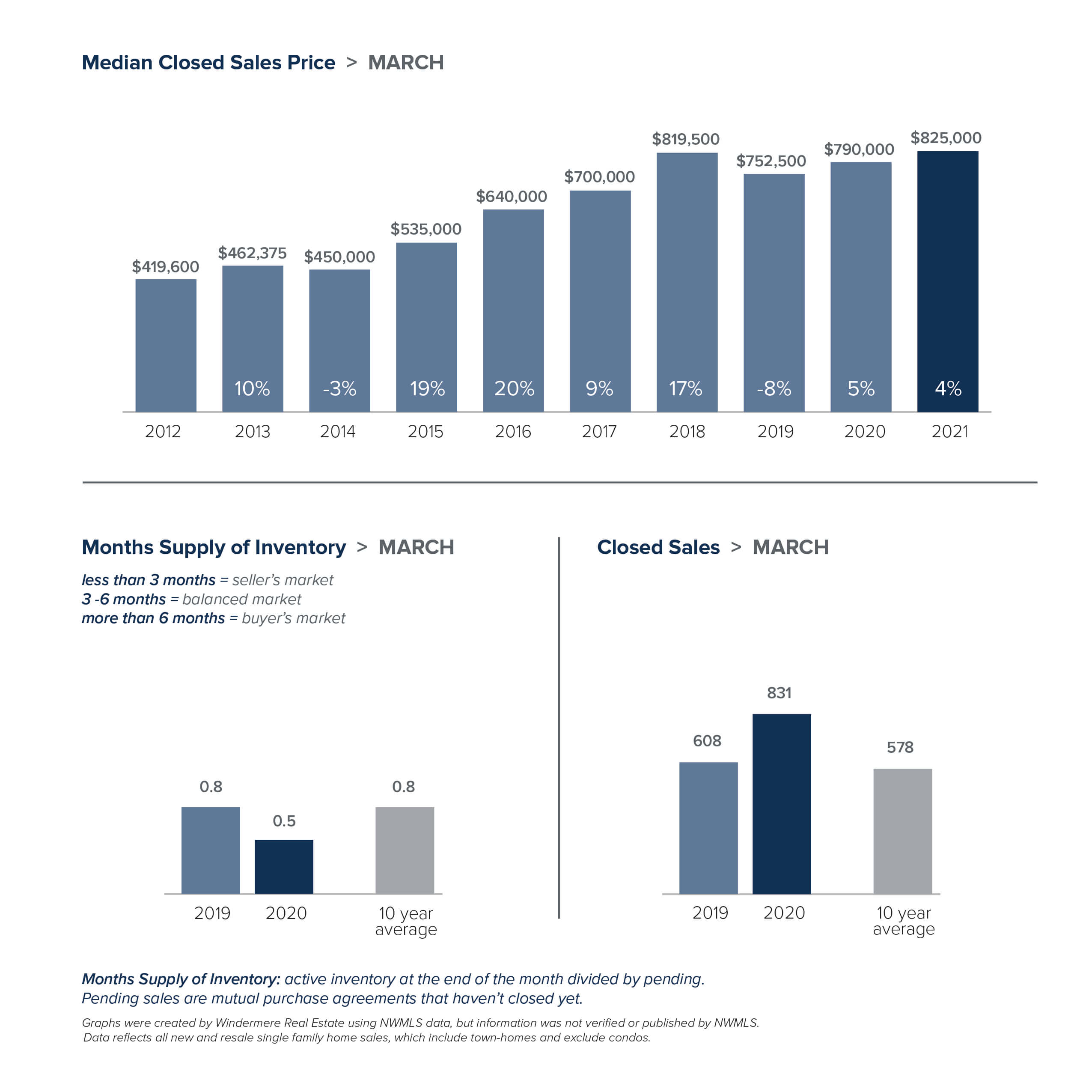

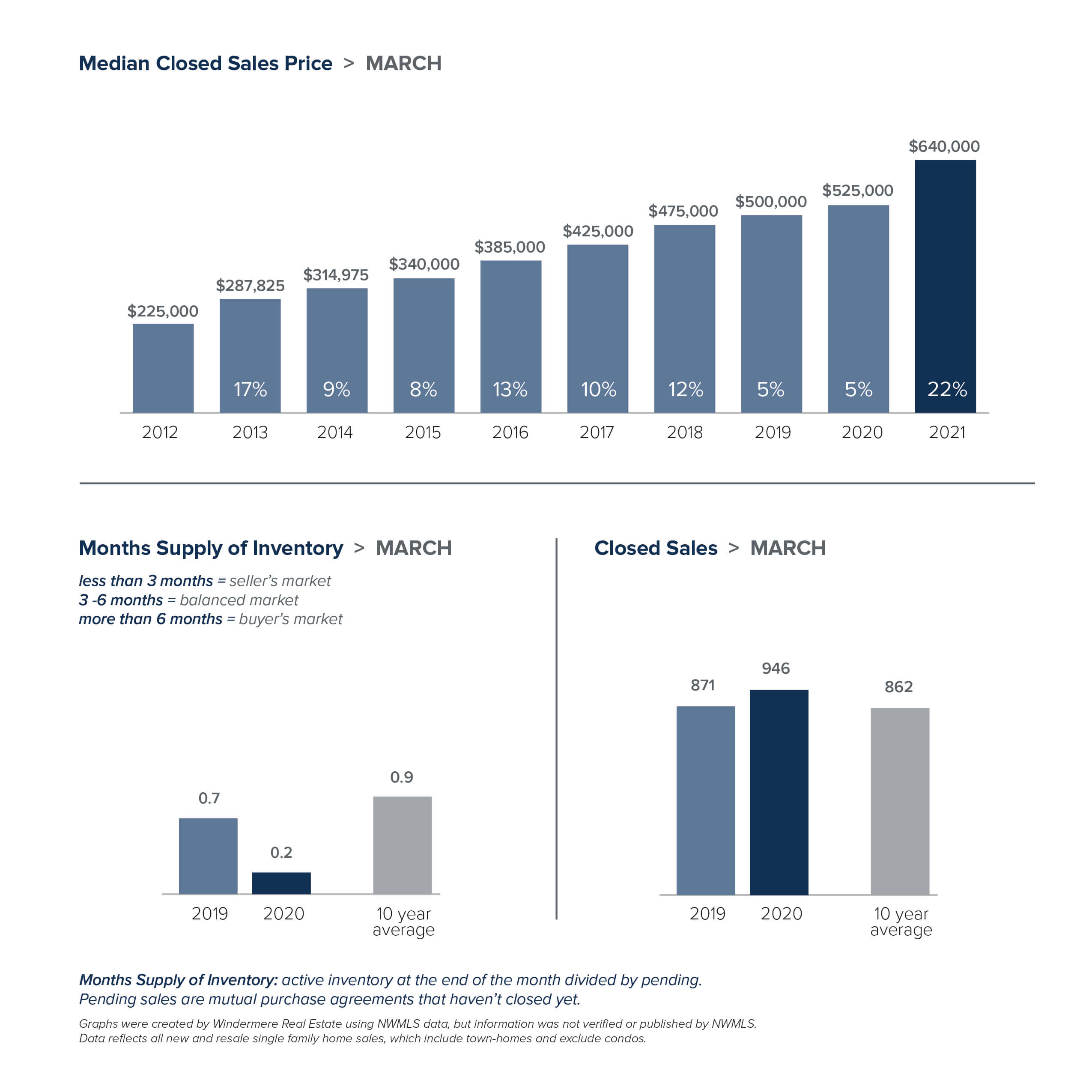

While the number of listings tanked, the number of sales skyrocketed. That’s the recipe for soaring home prices. Housing prices here have been growing at the second-fastest rate in the nation for a full year. Nearly every area of King County saw double-digit price increases, with the exception of Seattle. In King County the median price for a single-family home in March was a record-high $825,000, up 15% from a year ago and an increase of 10% from February. The median home price topped $1 million for every city on the Eastside, where the overall median price surged 30% to $1,350,000, the highest median price ever recorded for the area. Seattle homes prices were also record-breaking, rising 4% to $825,000. Snohomish County prices set yet another all-time high as the median home price jumped 22% to $640,000.

The appeal of our area just keeps growing. For the second time, Washington took the No. 1 spot in the U.S. News Best States ranking – the first state to earn the top ranking twice in a row. The bottom line: the local real estate market is extremely competitive, and it shows no signs of slowing down. Successfully navigating today’s market takes a strong plan. Your broker can work with you to determine the best strategies for your individual situation.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GettheWReport.com

Local Market Update – February 2021

This winter’s real estate market is looking more like a typical spring market. Sales were up, competition was fierce and prices continued to rise.

Lack of inventory still presents a huge issue. At the end of January there were only 1,055 single-family homes on the market in all of King County, 33% fewer than a year ago. If that wasn’t tight enough, Snohomish County had only 298 single-family homes for sale, 63% fewer than a year ago. Condos remain a bright spot for buyers frustrated by the frenzied market. January saw a nearly 50% increase in the number of condos for sale in King County. However, the increase in inventory didn’t translate into a drop in price. The median condo price was flat for the county, up 10% in Seattle and up 7% on the Eastside. Those looking for a relative bargain should consider Southwest and Southeast King County where the median condo prices were $254,275 and $269,900 respectively.

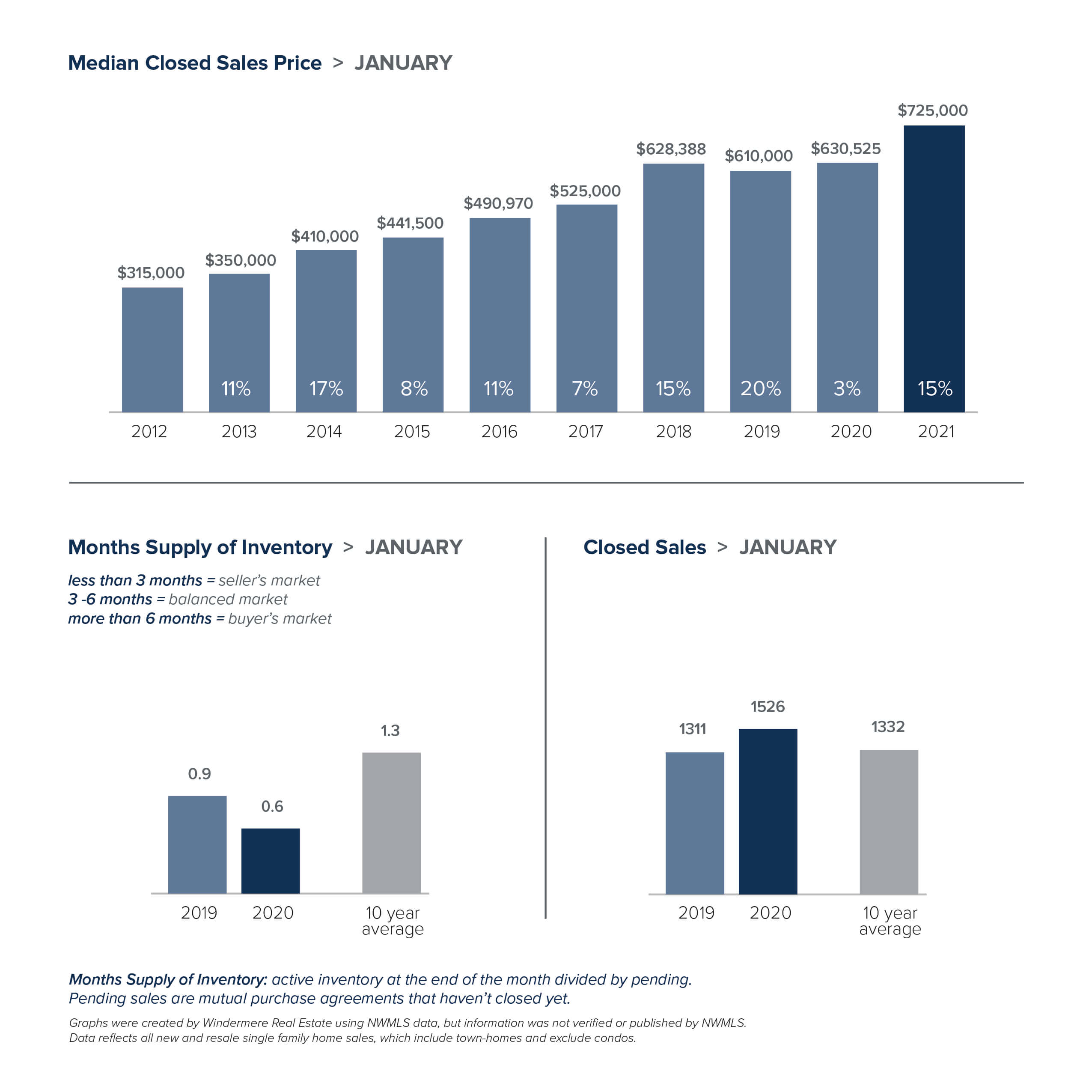

The large imbalance between supply and demand sent prices higher. Home prices here are climbing at the second-fastest rate in the nation. The median price of a single-family home in King County was $725,000, a 15% jump from a year ago. Seattle home prices increased 10% to $791,471. Inventory on the Eastside was down 58%, sending the median home price soaring 29% to $1.15 million. Snohomish County saw prices rise 18% to $599,990, well surpassing its previous high of $575,000.

While low interest rates take some of the sting out of rising prices, multiple offers over asking price have become the norm and are expected to continue. The easing of COVID restrictions may add yet more competition. Both King and Snohomish counties have moved into Phase 2 of the Healthy Washington plan, which allows open houses to resume with up to 10 people socially distanced.

All signs point to this strong seller’s market continuing for some time. The person who represents you as a buyer can make the difference in owning a home or not. Brokers are advising buyers to create a plan that prioritizes their wish list and sets realistic expectations in this hyper-competitive market.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Q4 2020 Western Washington Real Estate Market Update

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact me or another team member at Ali Mills Group!

REGIONAL ECONOMIC OVERVIEW

After the COVID-19-induced declines, employment levels in Western Washington continue to rebuild. Interestingly, the state re-benchmarked employment numbers, which showed that the region lost fewer jobs than originally reported. That said, regional employment is still 133,000 jobs lower than during the 2020 peak in February. The return of jobs will continue, but much depends on new COVID-19 infection rates and when the Governor can reopen sections of the economy that are still shut down. Unemployment levels also continue to improve. At the end of the quarter, the unemployment rate was a very respectable 5.5%, down from the peak rate of 16.6% in April. The rate varies across Western Washington, with a low of 4.3% in King County and a high of 9.6% in Grays Harbor County. My current forecast calls for employment levels to continue to improve as we move through the spring. More robust growth won’t happen until a vaccine becomes widely distributed, which is unlikely to happen before the summer.

WESTERN WASHINGTON HOME SALES

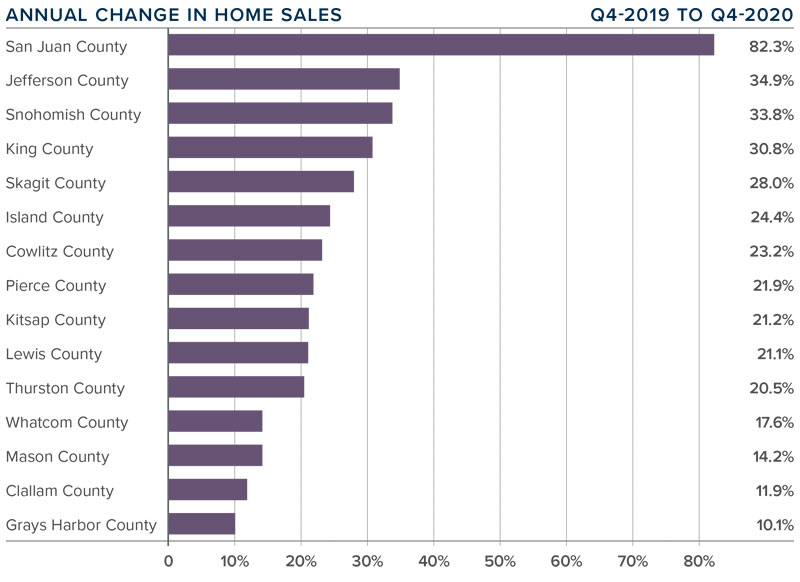

❱ Sales continued to impress, with 23,357 transactions in the quarter. This was an increase of 26.6% from the same period in 2019, but 8.3% lower than in the third quarter of last year, likely due to seasonality.

❱ Listing activity remained very low, even given seasonality. Total available inventory was 37.3% lower than a year ago and 31.2% lower than in the third quarter of 2020.

❱ Sales rose in all counties, with San Juan County seeing the greatest increase. This makes me wonder if buyers are actively looking in more remote markets given ongoing COVID-19 related concerns.

❱ Pending sales—a good gauge of future closings—were 25% higher than a year ago but down 31% compared to the third quarter of 2020. This is unsurprising, given limited inventory and seasonal factors.

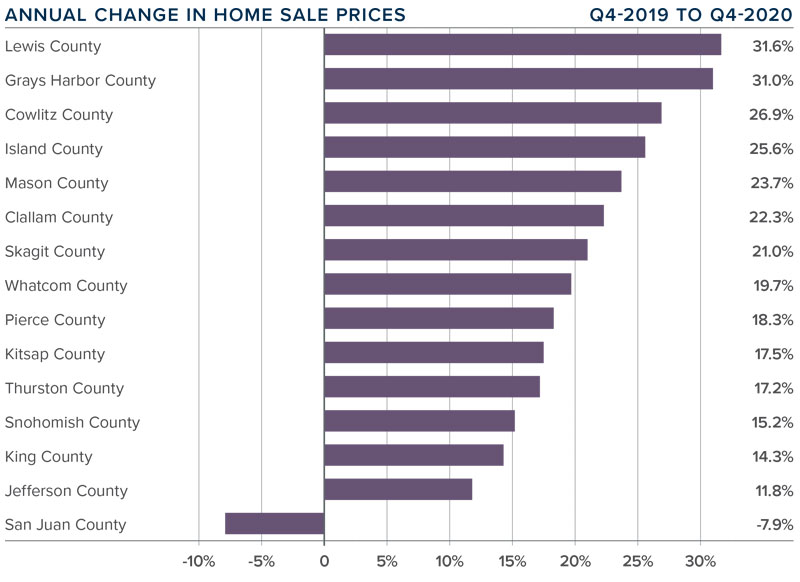

WESTERN WASHINGTON HOME PRICES

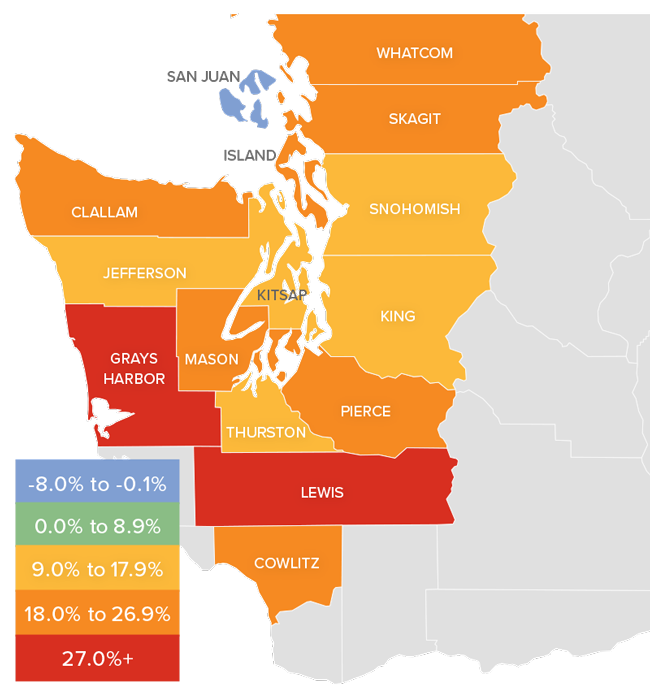

❱ Home price growth in Western Washington continued the trend of above-average appreciation. Prices were up 17.4% compared to a year ago, with an average sale price of $617,475.

❱ Year-over year price growth was strongest in Lewis and Grays Harbor counties. Home prices declined in San Juan County which is notoriously volatile because of its small size.

❱ It is interesting to note that home prices were only 1% higher than third quarter of 2020. Even as mortgage rates continued to drop during the quarter, price growth slowed, and we may well be hitting an affordability ceiling in some markets.

❱ Mortgage rates will stay competitive as we move through 2021, but I expect to see price growth moderate as we run into affordability issues, especially in the more expensive counties.

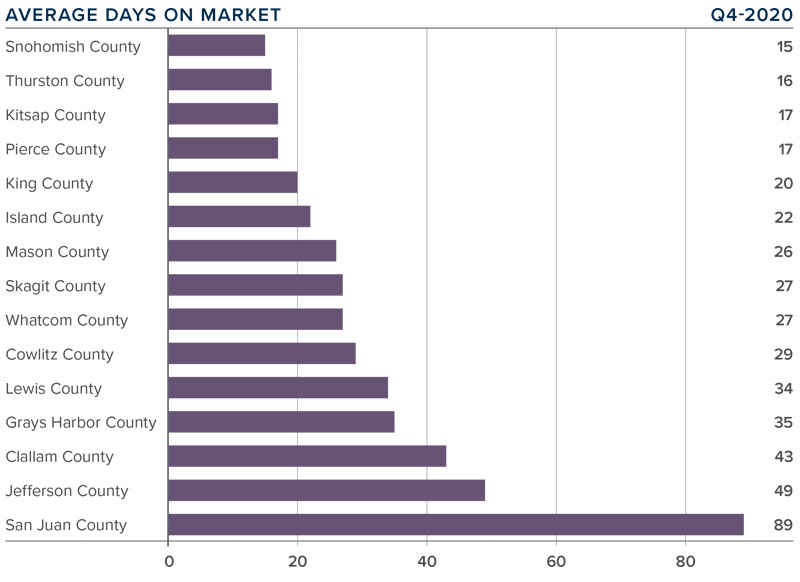

DAYS ON MARKET

❱ 2020 ended with a flourish as the average number of days it took to sell a home in the final quarter dropped by a very significant 16 days compared to a year ago.

❱ Snohomish County was again the tightest market in Western Washington, with homes taking an average of only 15 days to sell. The only county that saw the length of time it took to sell a home rise compared to the same period a year ago was small Jefferson County, but it was only an increase of four days.

❱ Across the region, it took an average of 31 days to sell a home in the quarter. It is also worth noting that, even as we entered the winter months, it took an average of five fewer days to sell a home than in the third quarter of last year.

❱ The takeaway here is that demand clearly remains strong, and competition for the few homes available to buy continues to push days on market lower.

CONCLUSIONS

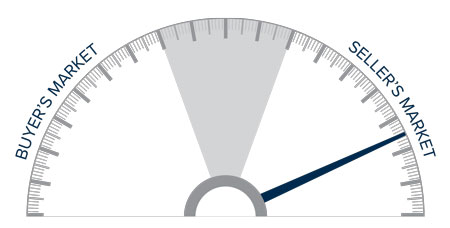

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Demand has clearly not been impacted by COVID-19, mortgage rates are still very favorable, and limited supply is causing the region’s housing market to remain incredibly active. Because of these conditions, I am moving the needle even further in favor of sellers.

2021 is likely to lead more homeowners to choose to move if they can work from home, which will continue to drive sales growth and should also lead to more inventory. That said, affordability concerns in markets close to Western Washington’s job centers, in combination with modestly rising mortgage rates, should slow the rapid home price appreciation we have seen for several years. I, for one, think that is a good thing.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog

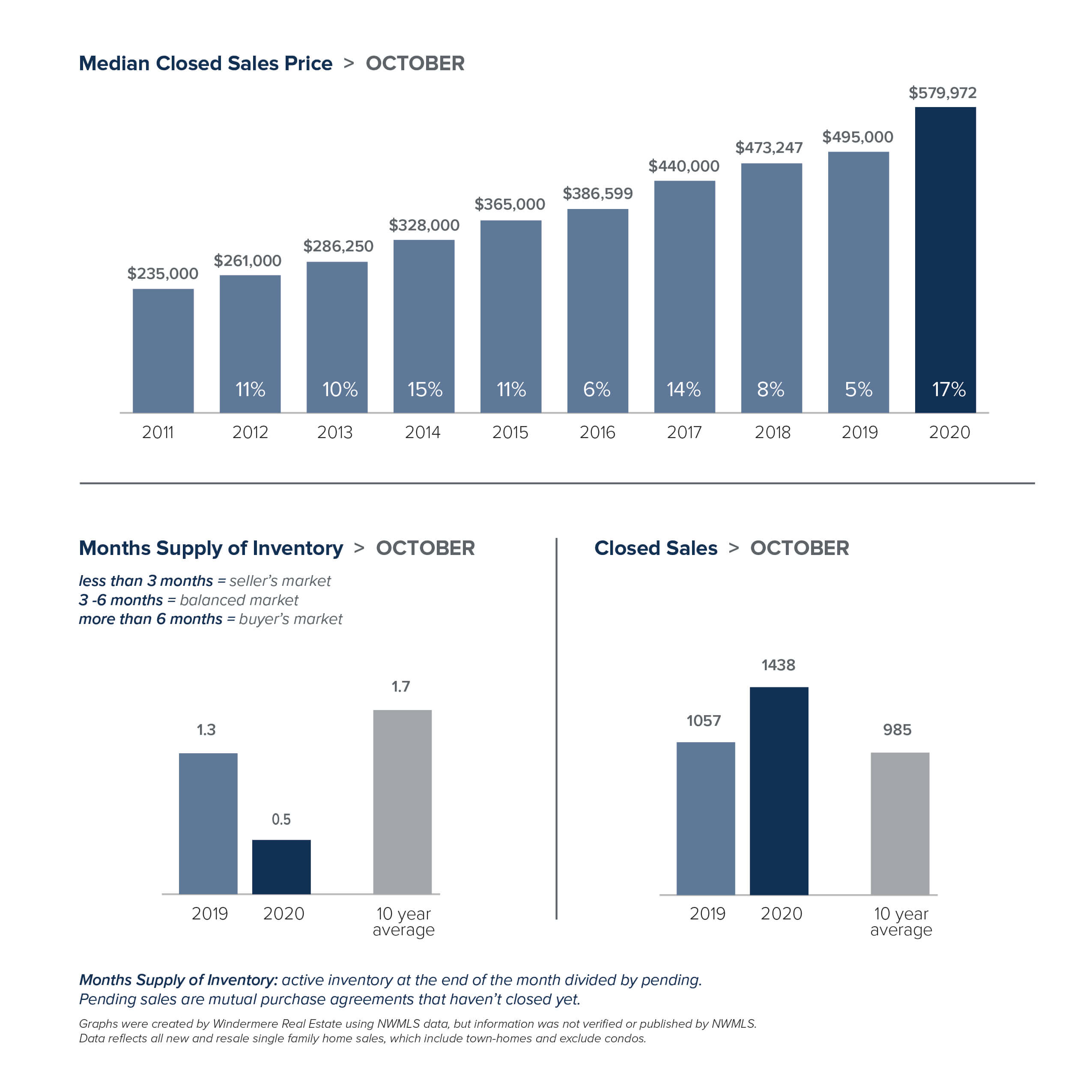

Local Market Update – November 2020

The number of people who can work remotely may be changing the way we view our homes, but one trend has not changed. The local housing market in October remained unseasonably hot. And that doesn’t show signs of changing any time soon.

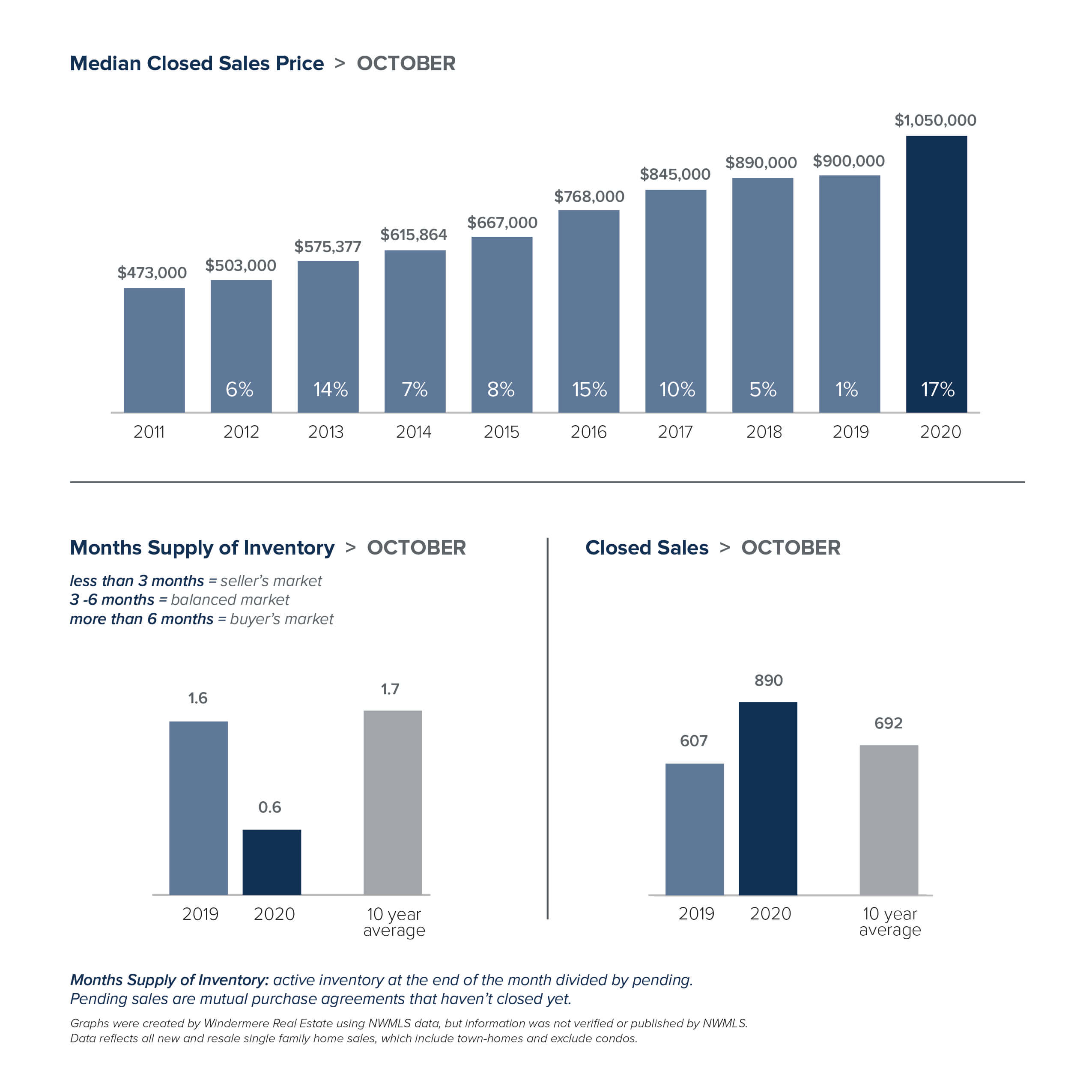

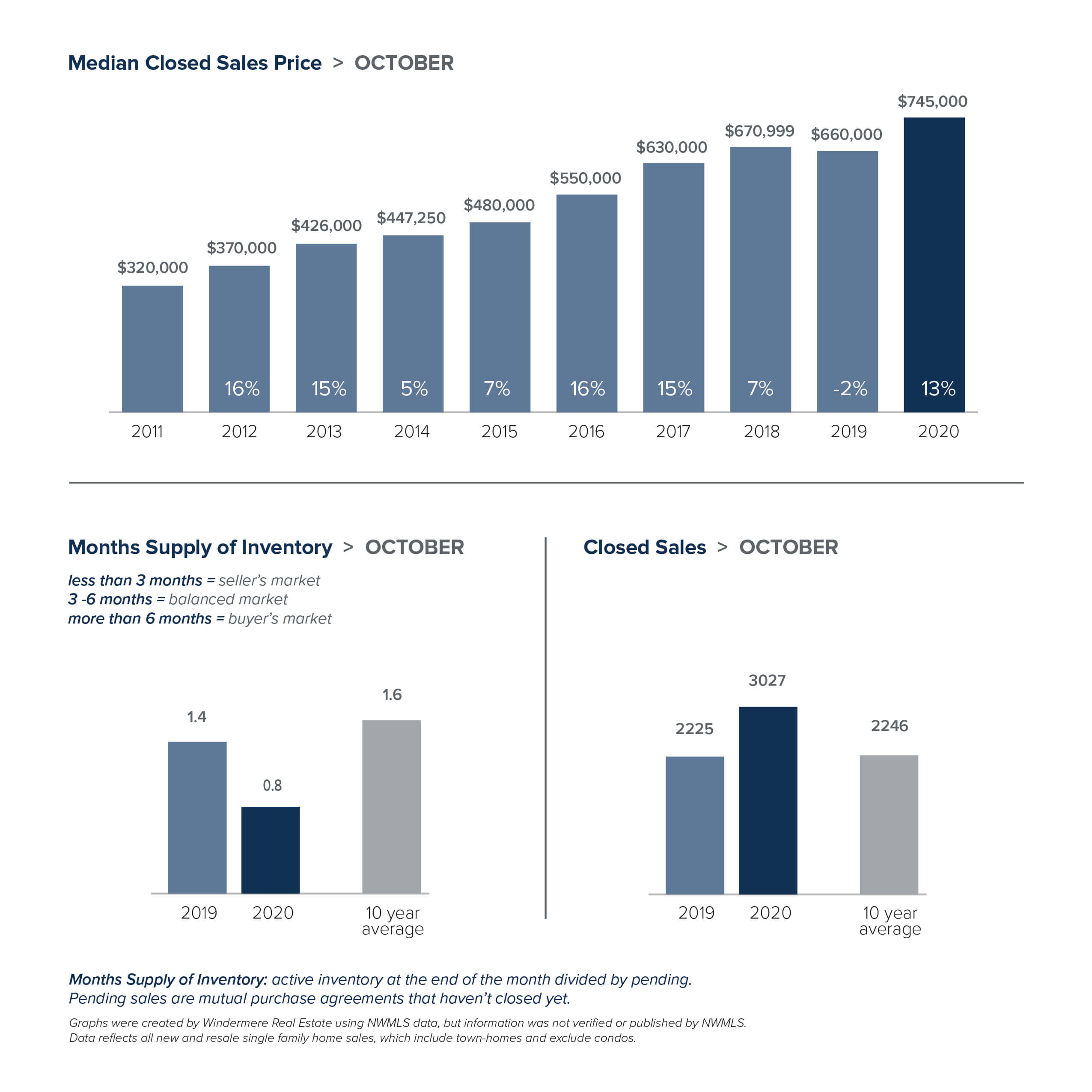

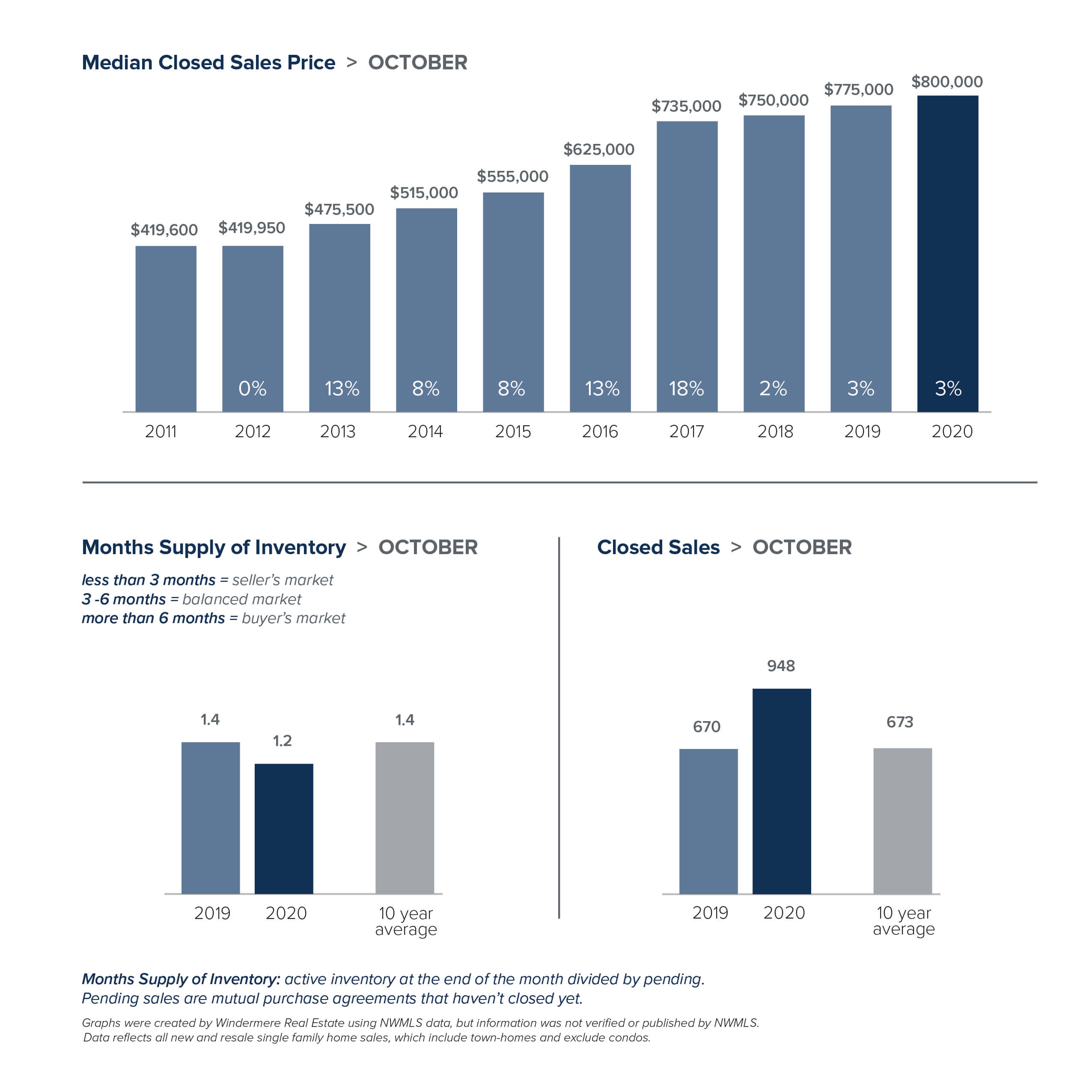

October saw continued low inventory and record-level sales, with the number of sales exceeding that of 2019 year-to-date.

While new listings are on the rise, they are being snapped up quickly and many homes are selling in a matter of days. In King County there were 38% fewer single-family homes on the market as compared to a year ago. Snohomish County had 59% fewer listings. A four-month supply of homes for sale is considered a balanced market, but King and Snohomish counties currently have less than one month of supply.

With supply unable to keep up with demand, home prices are escalating at double-digit rates. The median single-family home price in King County rose 14% over a year ago to $745,000. Prices in Snohomish County jumped 17% year-over-year to a record high of $579,972. About half the homes that closed in October sold for over the asking price as compared to about a quarter of the homes the same time last year.

The real estate market here is uncommonly resilient. Growing employment in major tech industries and an enviable quality of life have made our region one of the fastest growing areas in the country. With interest rates remaining at record lows, we may well skip the traditional slowing in the winter market altogether.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Western Washington Real Estate Market Update – Q3 2020

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

REGIONAL ECONOMIC OVERVIEW

Employment numbers in Western Washington continue to improve following the massive decline caused by COVID-19. For perspective, the area shed more than 373,000 jobs between February and April. However, the recovery has been fairly robust: almost 210,000 of those jobs have returned. Unemployment levels remain elevated; the current rate is 8.2%. That said, it is down from 16.6% in April. The rate, of course, varies across Western Washington counties, with a current low of 7.2% in King County and a high of 11.2% in Grays Harbor County. The economy is healing, but the pace of improvement has slowed somewhat, which is to be expected. That said, I anticipate that jobs will continue to return as long as we do not see another spike in new infections.

HOME SALES

- Sales continued to improve following the COVID-19-related drop in the first quarter of the year. There were 25,477 transactions in the quarter, an increase of 11.6% from the same period in 2019, and 45.9% higher than in the second quarter of this year.

- Listing activity remains woefully inadequate, with total available inventory 41.7% lower than a year ago, but 1.6% higher than in the second quarter of this year.

- Sales rose in all but two counties, though the declines were minimal. The greatest increase in sales was in San Juan County, which leads one to wonder if buyers are actively looking in more isolated markets given ongoing COVID-19-related concerns.

- Pending sales—a good gauge of future closings—rose 29% compared to the second quarter of the year, suggesting that fourth quarter closings will be positive.

HOME PRICES

- Home-price growth in Western Washington rose a remarkable 17.1% compared to a year ago. The average sale price was $611,793.

- When compared to the same period a year ago, price growth was strongest in Mason, Island, and San Juan counties. Only one county saw prices rise by less than ten percent.

- It was even more impressive to see the region’s home prices up by a very significant 9.4% compared to the second quarter of 2020. It is clear that low mortgage rates, combined with limited inventory, are pushing prices up.

- As long as mortgage rates stay low, and there isn’t an excessive spike in supply (which is highly unlikely), prices will continue to rise at above-average rates. That said, if this continues for too long, we will start to face affordability issues in many markets.

DAYS ON MARKET

- The average number of days it took to sell a home in the third quarter of this year dropped two days compared to a year ago.

- Snohomish County was the tightest market in Western Washington, with homes taking an average of only 16 days to sell. All but two counties—Lewis and San Juan—saw the length of time it took to sell a home rise compared to the same period a year ago.

- Across the region, it took an average of 36 days to sell a home in the quarter. It is also worth noting that it took an average of 4 fewer days to sell a home than in the second quarter of this year.

- The takeaway here is that significant increases in demand, in concert with remarkably low levels of inventory, continue to drive market time lower.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

High demand, favorable interest rates, and low supply clearly point to a seller’s market in Western Washington. As such, I am moving the needle even more in favor of sellers.

As I suggested earlier in this report, although the market is remarkably buoyant, I am starting to see affordability issues increase in many areas—not just in the central Puget Sound region—and this is concerning. Perhaps the winter will act to cool the market, but something is telling me we shouldn’t count on it.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog

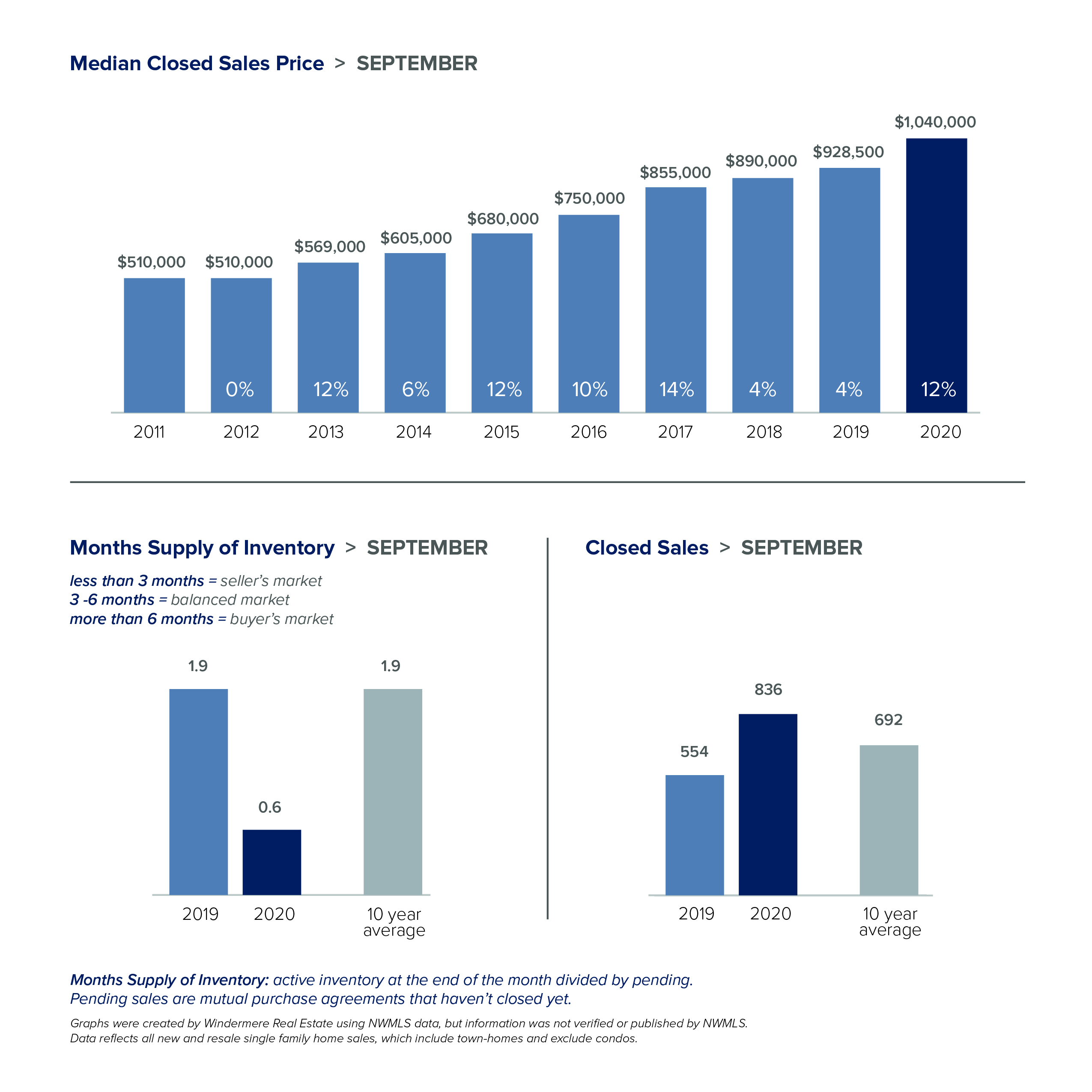

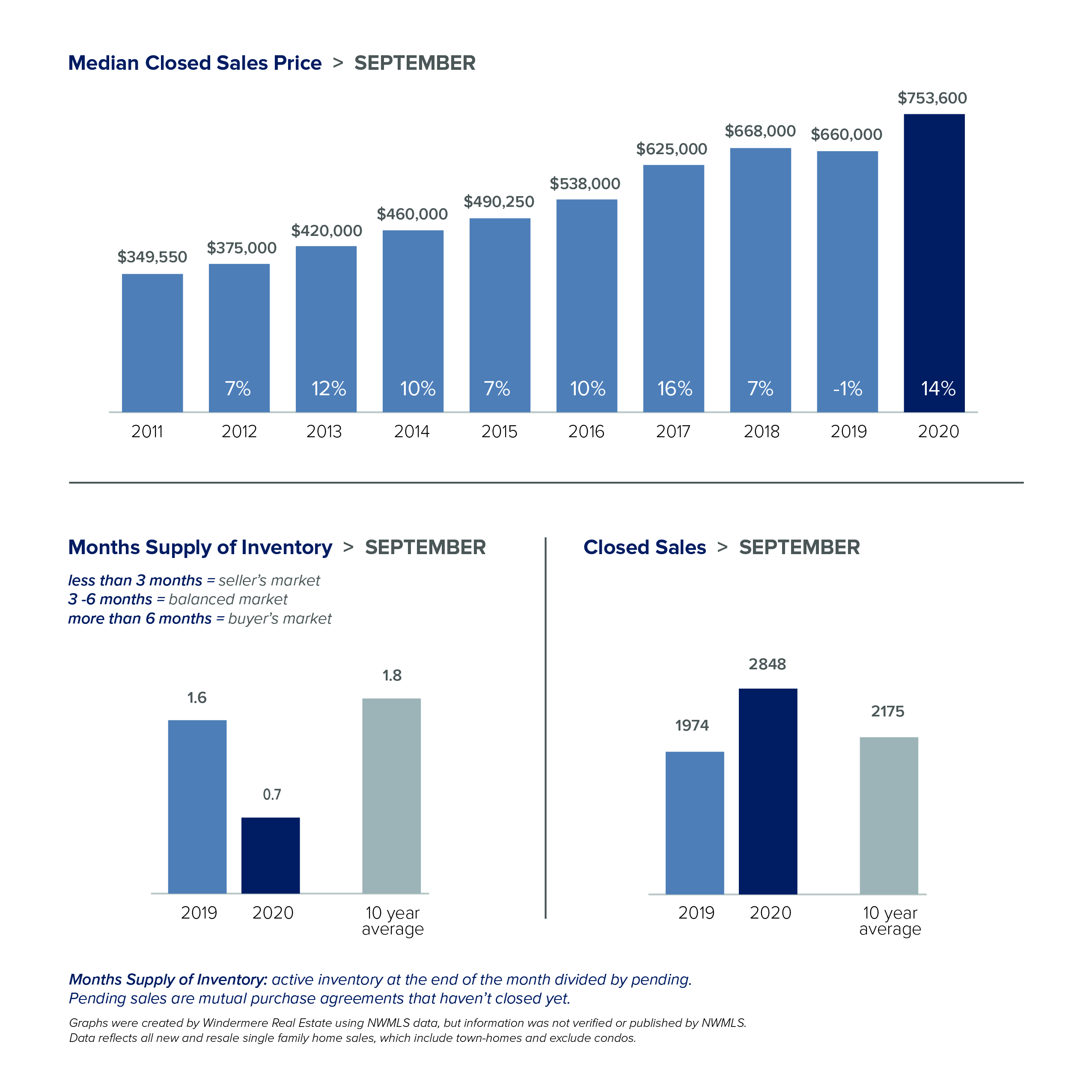

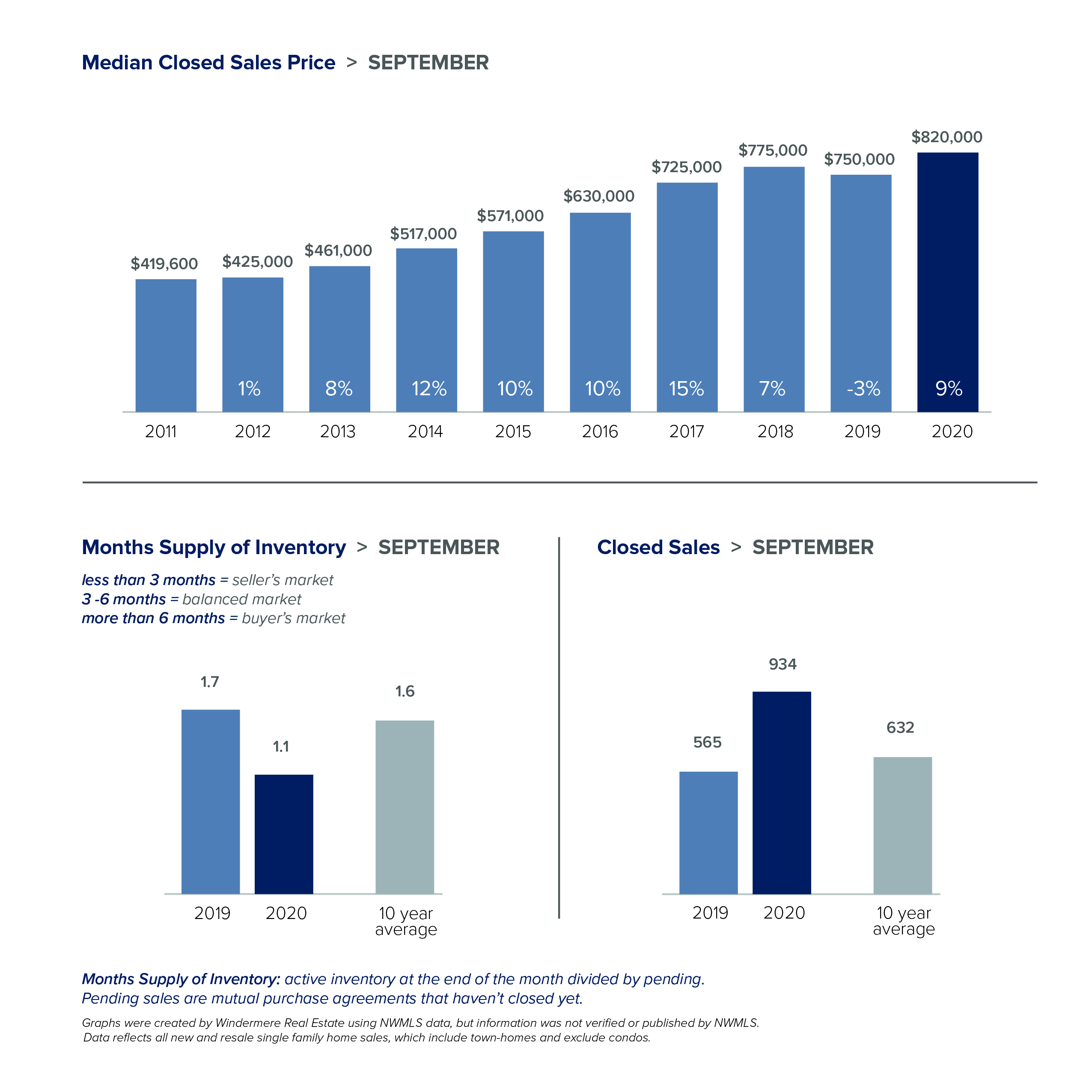

Local Market Update – October 2020

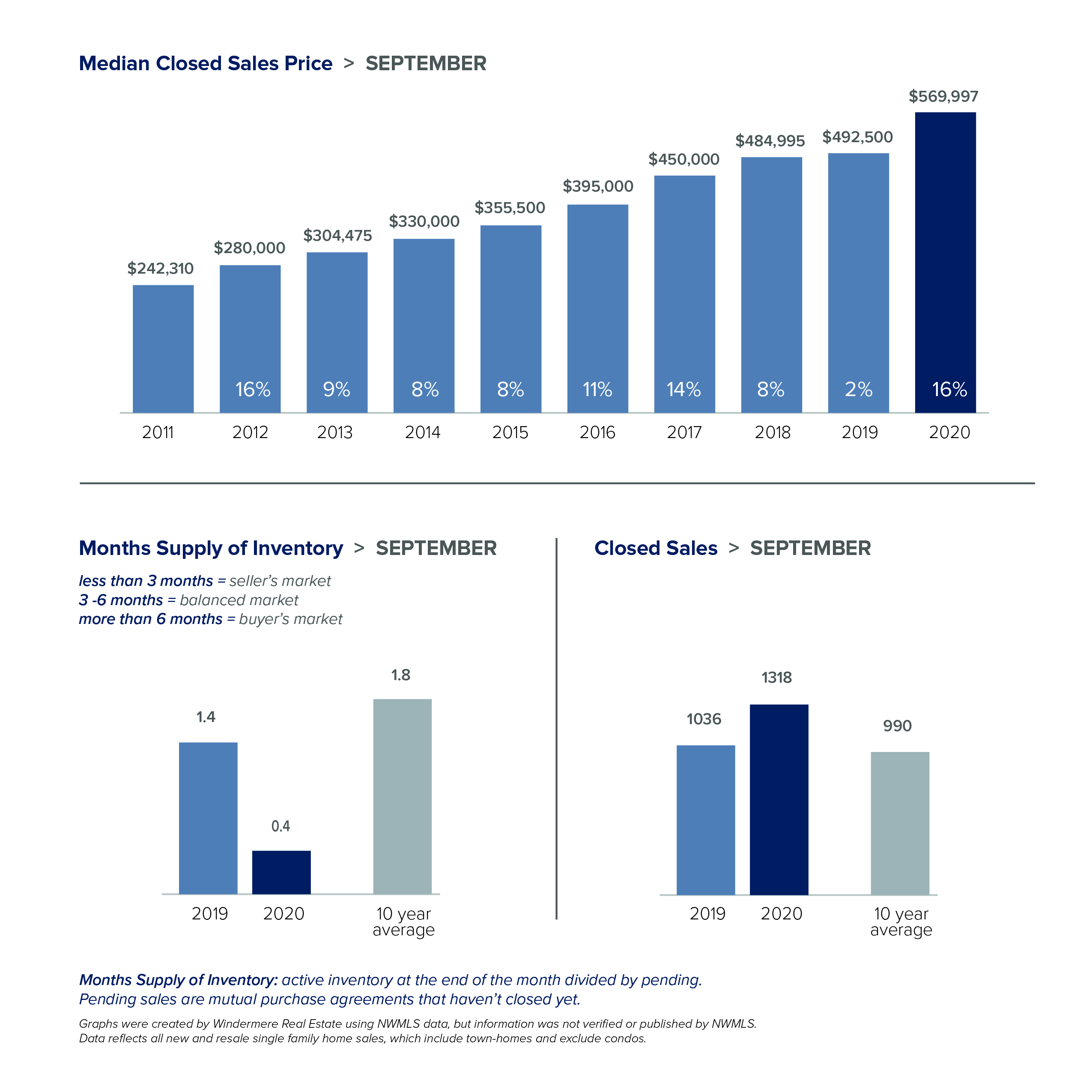

While daily life may seem unpredictable, the local real estate market remains extremely stable. Activity in September acted more like the traditional peak spring market with home sales soaring and prices hitting record highs. Inventory remains very tight and new listings are selling quickly in every price range.

There just aren’t enough homes on the market to meet demand. King County had about half the inventory of a year ago. Snohomish County had 63% fewer available homes. On the other hand, the number of condos on the market in King County jumped by 24% over last September. Brokers attribute the flood of new inventory to COVID remote workers looking to trade their in-city condo for more living space. Despite the increase in inventory, condo prices rose 8% in September and pending sales — the best indicator of current demand — shot up 36% over the same period last year.

The slim supply of single-family homes means bidding wars and all-cash offers were the norm, driving prices to record highs. King County saw the third consecutive month of record-setting values. The median home price hit $753,600 in September, a 14% jump over last year. Prices in Snohomish County soared 16% from a year ago to $569,997, just shy of its all-time high of $575,000. For both counties, half the homes sold for over list price in September as compared with just a quarter of the homes a year ago.

The market doesn’t show signs of cooling off any time soon. In September the greater Northwest area saw the highest number of transactions since June 2018. Pending sales were up 32% in King County and 29% in Snohomish County. Interest rates continue to be at historic lows. With the area posting some of the fastest population growth in the country, expect the market to stay unseasonably hot.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GettheWReport.com

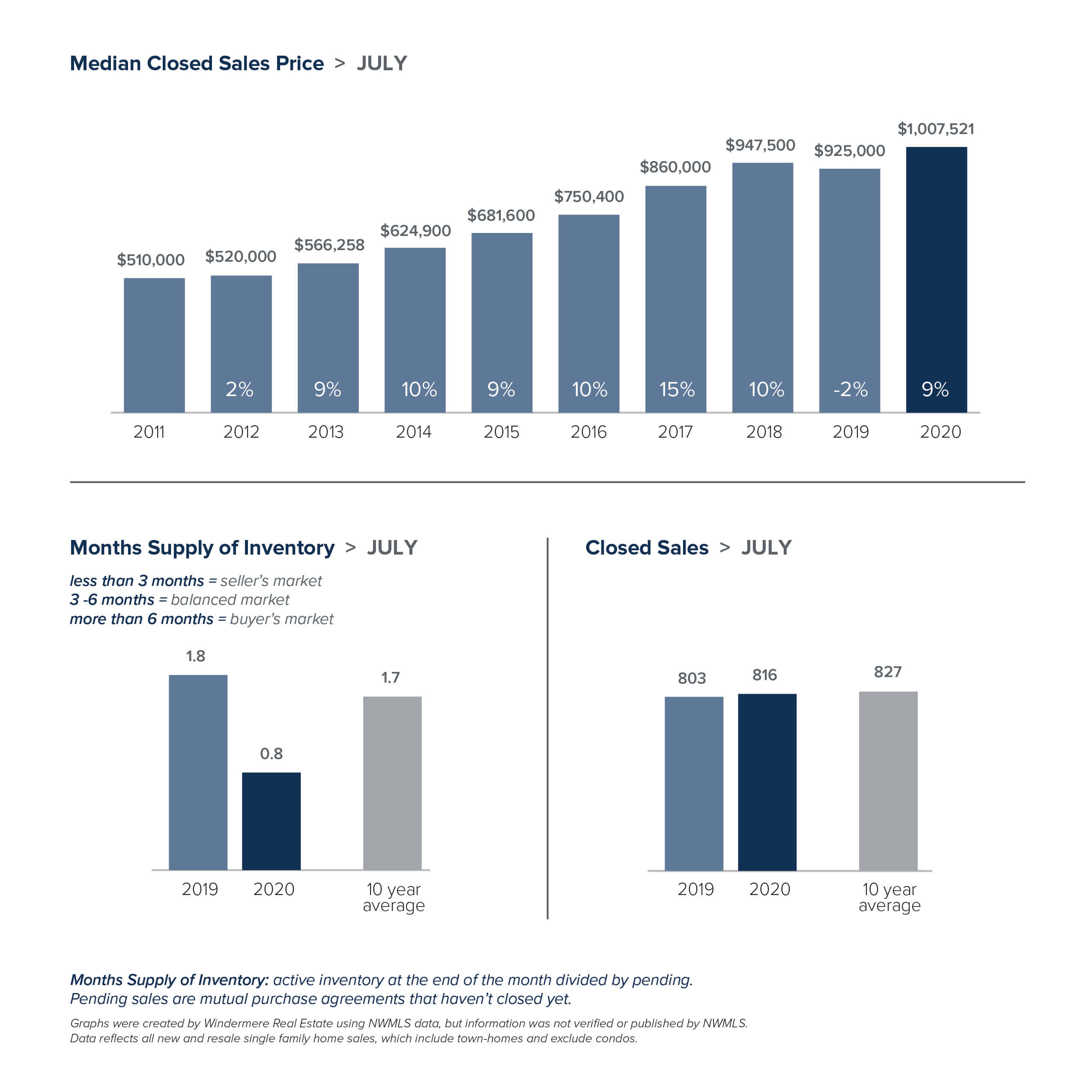

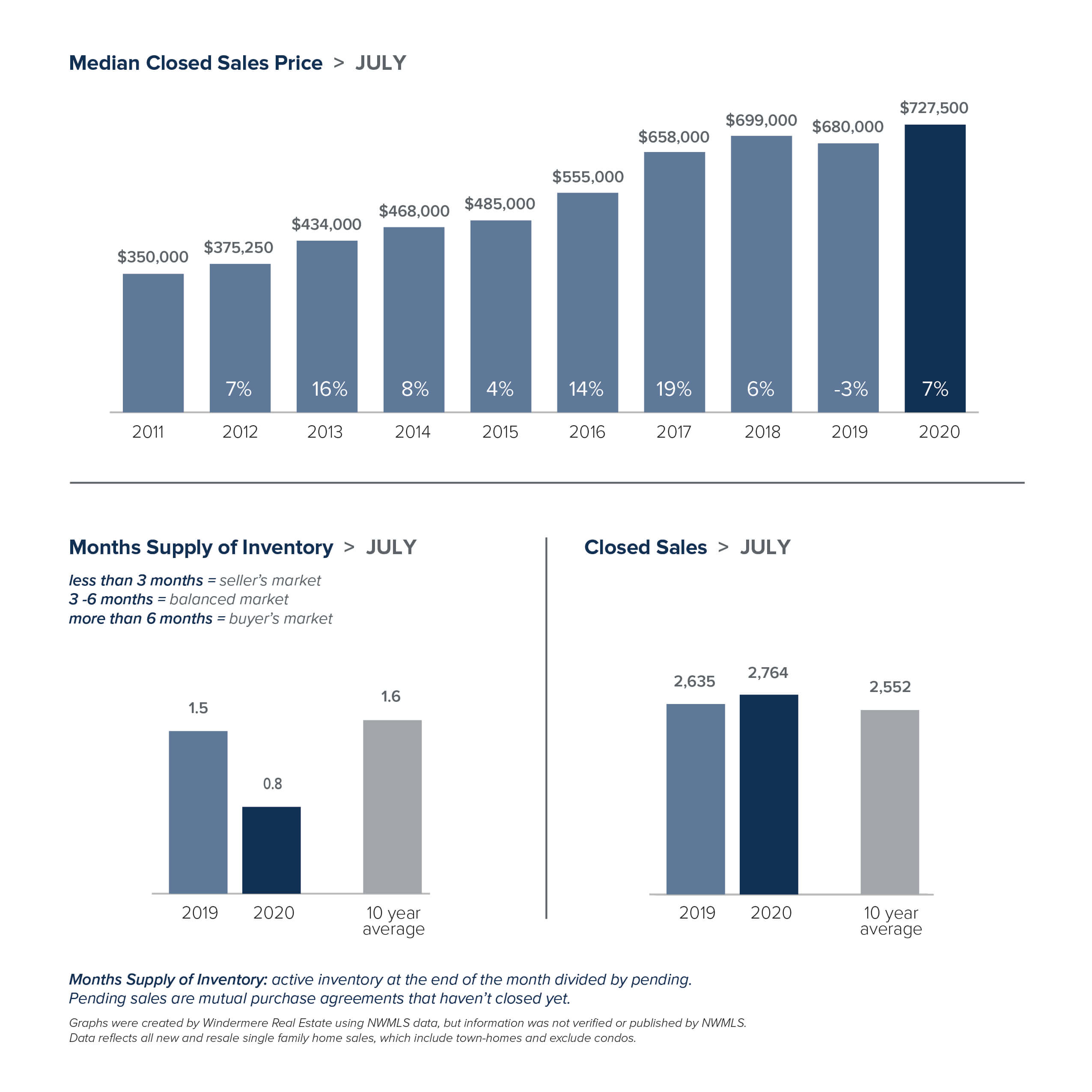

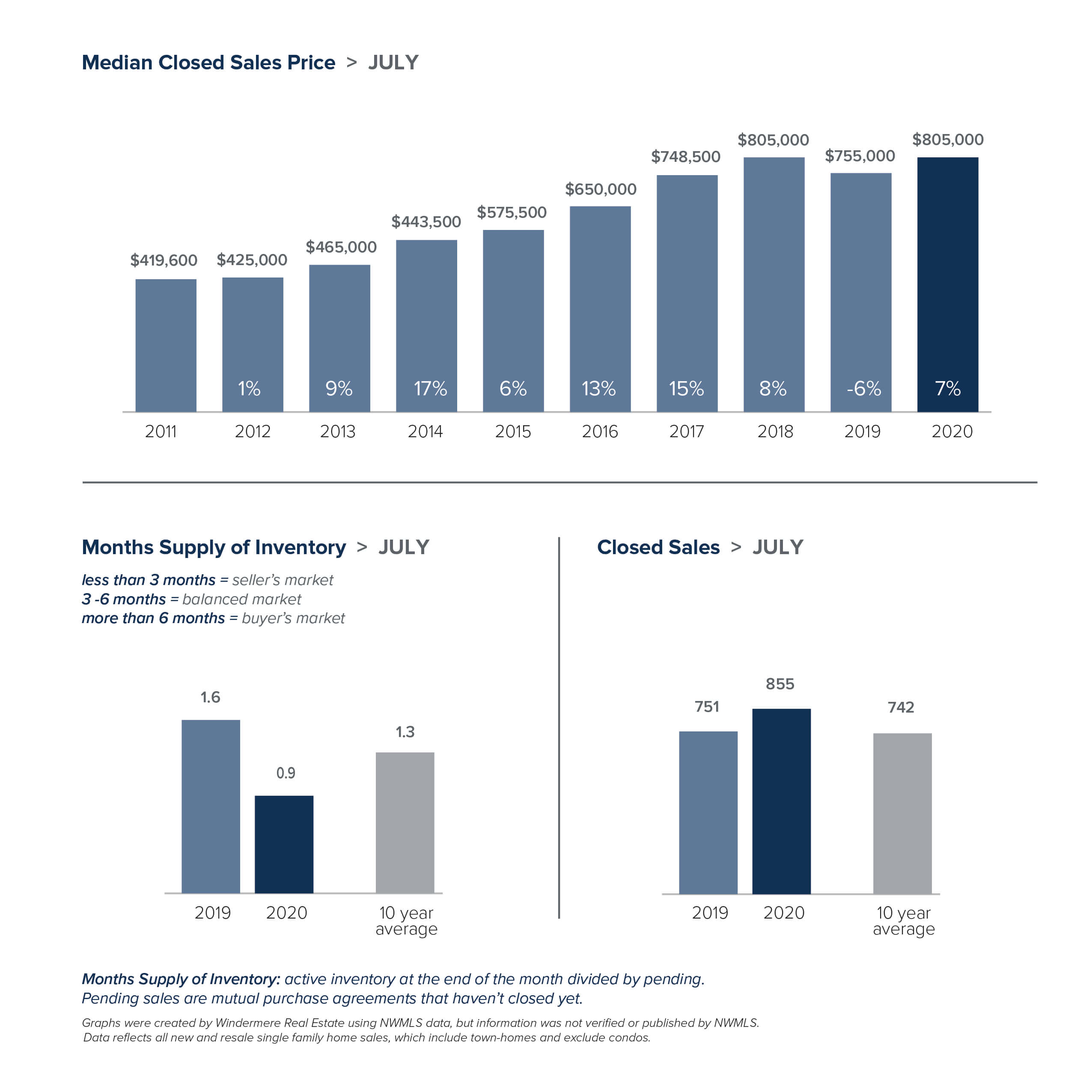

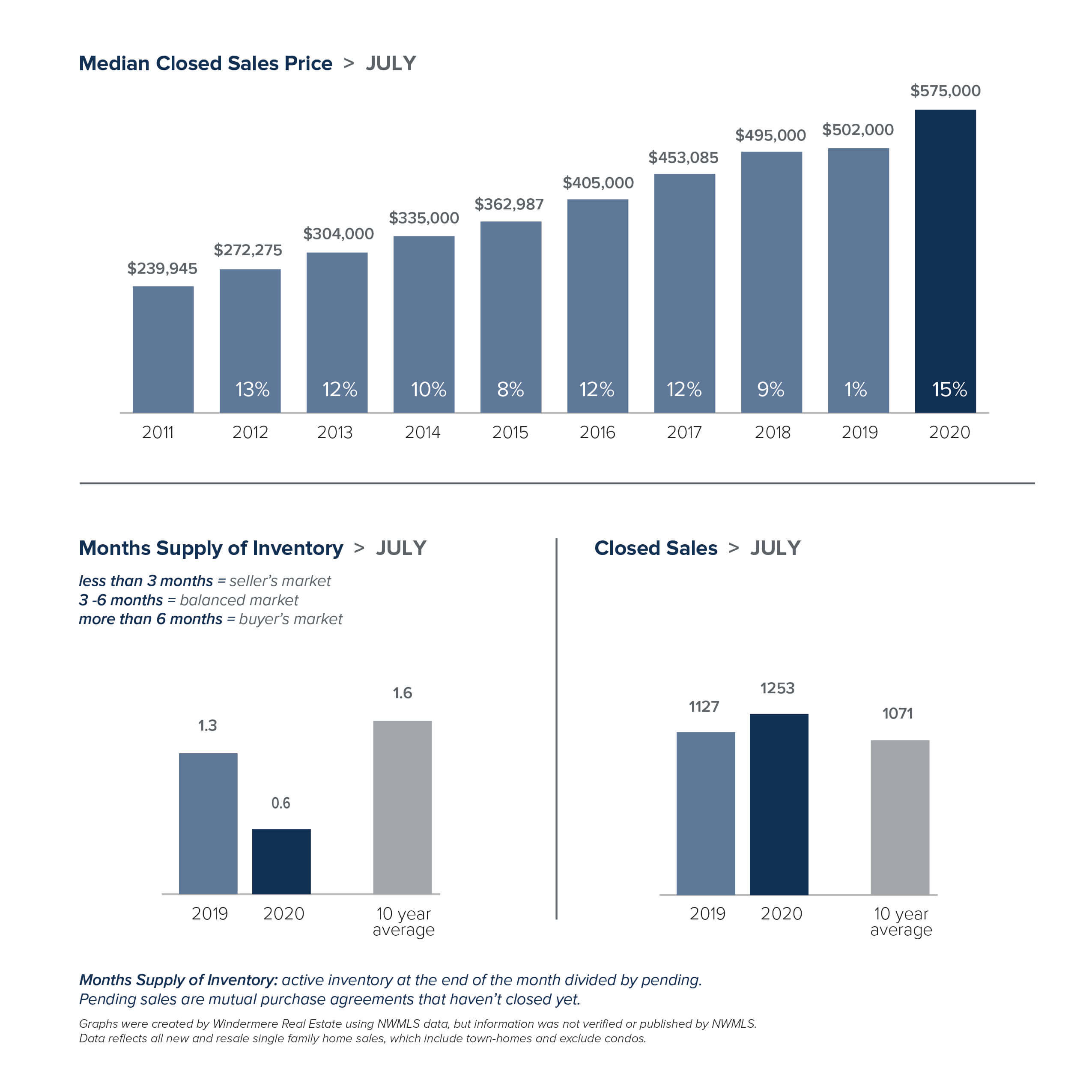

Local Market Update – August 2020

While the pace of daily life may seem slow right now, the

local real estate market has had an unusually busy summer. The number of

new listings in July was up, sales increased, and home prices followed

suit.

• While overall inventory is at historic lows, more sellers put their homes on

the market. New listings of single-family homes in King County jumped more than

25% from a year ago. Snohomish County saw a 7% increase in new listings.

• Pent-up buyer demand fueled sales activity in July. The number of pending

sales was up 17% over a year ago in King County, and up 13% in Snohomish

County.

• With buyers snapping up new listings as soon as they hit the market, total

available inventory dropped to a 10-year low for the month.

• The lack of inventory is benefiting sellers, and multiple offers are now common

at every price point. As a result, single-family home prices rose 7% in King

County and 15% in Snohomish County.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Could New Seattle Tax Prompt Amazon to Consider Moving?

Once again, Seattle is attempting to leverage a tax on big businesses in the city, potentially ruffling the feathers of some of the city’s corporate behemoths. On Monday, July 6, the city council passed its latest big business tax proposal titled “JumpStart Seattle.” This might just be the last straw for Amazon, according to Windermere’s Chief Economist, Matthew Gardner.

If enacted, the proposal will raise over $200 million a year for the city. It will generate revenue through a tiered system of taxation on companies with payroll expenses over $7 million, although the tax only applies to the salaries of higher income employees. Employers in the lowest bracket will be taxed 0.7% of annual salaries between $150,000–$399,999, and 1.7% of annual salaries exceeding $400,000. The city has devised a separate tier for companies with annual payroll expenses over $1 billion, likely designed specifically with Amazon in mind. Employers in this tier will be taxed 1.4% of annual salaries between $150,000–$399,999, and 2.4% of annual salaries exceeding $400,000.

The tax is similar to the proposed head tax that was passed and quickly repealed by Seattle in 2018 due to the same fears of driving business out of the city. Initially, the proceeds from the new tax will be used to address needs related to coronavirus, but eventually the funds will be directed toward addressing homelessness and housing issues in Seattle.

The problem with the new tax, according to Gardner, is that it wasn’t applied regionally.

“As much as these [taxes] might make sense, they need to be applied on a regional, not citywide basis,” Gardner told KIRO Radio host Dave Ross.

By not coordinating the tax with nearby cities like Redmond and Bellevue, Seattle has only further incentivized Amazon to grow investments in new hubs outside of the city. Notably, after the near-miss with the head tax of 2018, Amazon moved many of its employees and operations to nearby Bellevue in 2019.

Gardner doesn’t approve of Seattle’s attempt to autonomously grapple with this issue. “All it does is it functions to push people out,” he said.

According to CNBC, in June 2020 Amazon announced it would lease 111,000 square feet of workspace for employees in Redmond. Bellevue, meanwhile, is to be the site of a newly built 43-story tower for Amazon operations.

While Amazon hasn’t made any official announcements regarding its plans for future operations in the region since the new tax was passed, Gardner expects we’ll be hearing from them soon. “I think there’s no doubt that we’re going to hear several announcements over the next couple of weeks of some massive expansion by Amazon into Bellevue.”

Though the tax will likely go into effect in 2021, it will not begin collecting money until 2022. Until then, it’s anyone’s guess whether Seattle can entice Amazon to stay put, or if the allure of lower taxes on the Eastside will see Amazon relocating for good.

This post originally appeared on GettheWReport.com

Seattle’s Housing Market Remains Resilient Despite COVID-19

The Seattle area housing market in May continued to show resiliency amid the novel coronavirus outbreak, with increases compared to the previous month in new listings and pending sales.

A report from Northwest Multiple Listing Service — which covers 23 counties in the region — showed King County had 3,585 new listings during May, compared with 2,707 new listings that came on the market during April. The total number of active listings in King County also went up slightly month over month, from 3,255 in April to 3,467 in May.

“The market has proved to be very resilient,” Northwest Multiple Listing Service Director Mike Larson said in a news release.

But the number of active listings in May of this year was still about 40% lower than the total active listings in May of last year, according to the report.

The report also found pending sales in King County went up month over month, from 2,246 to 3,358. But the number of pending sales was about 20% lower than it was at the same time last year.

The median home price for closed sales in King County dropped month over month, from $650,000 to $627,000.

“I don’t think anyone should be surprised that home prices in King County took a ‘breather’ in May,” said Matthew Gardner, Windermere Real Estate Chief Economist. “Clearly COVID-19 was the cause for this drop, but I’m confident this is a temporary situation that will be reversed as King County starts to reopen, and fresher inventory comes to market.”

Gardner said he expects prices to go up again in the months ahead.

While the local housing market is still hot, it looks a bit different than in previous years. The number of new listings dropped in the first few months of the shutdown, but homes going under contract (pending sales) are on the road to recovery.

The pandemic caused some sellers to put their sale on pause, compounding the fact that the Seattle housing market was already experiencing low inventory and strong buyer demand.

The drastically low inventory is posing some challenges, making it feel like there just aren’t enough homes. Properties under $1 million are selling quickly, with new listings going pending after just a few days on the market. Bidding wars and multiple offer situations are again becoming commonplace. A balance in the market is unlikely until more sellers decide to list their homes and new construction accelerates to meet demand.

Since the start of the pandemic, real estate agents have been taking advantage of technology, doing virtual tours and using social media to interact with clients. Even as the pandemic put much of life on hold, people have continued needing to sell and buy homes.

While experts have said that uncertainty remains about the long-term impacts the coronavirus pandemic may have on the housing market and the region as a whole, real estate agents are staying positive. The market is strong with improving outlooks week over week.

A version of this article was first published on seattlepi.com by Becky Savransky, and on GettheWReport.com

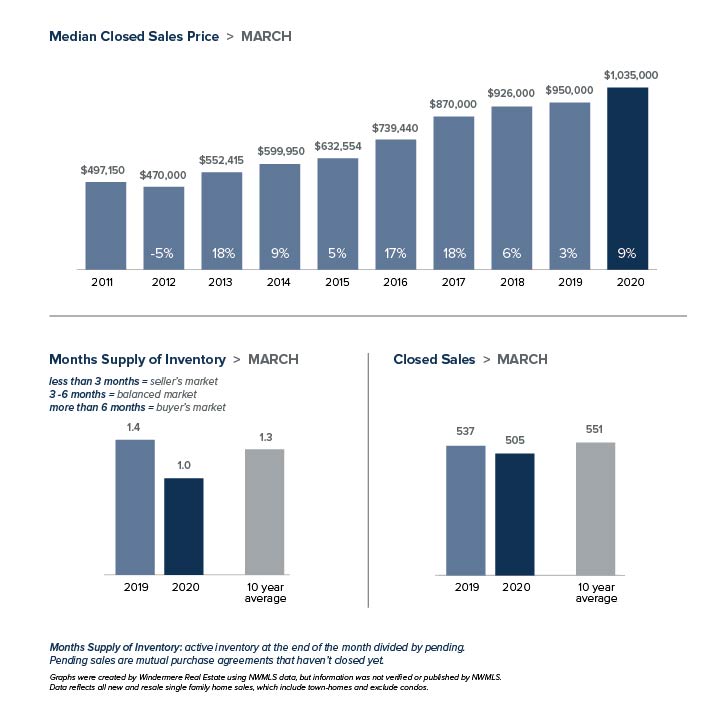

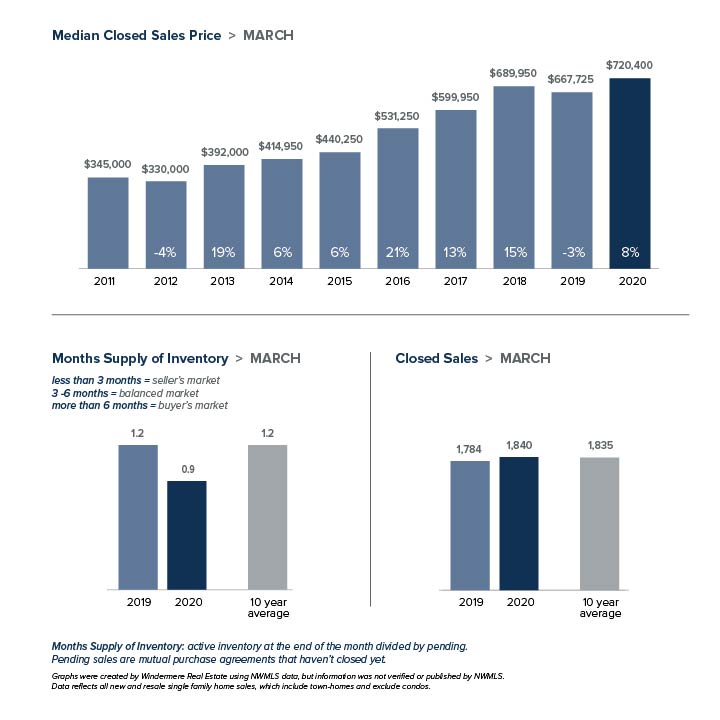

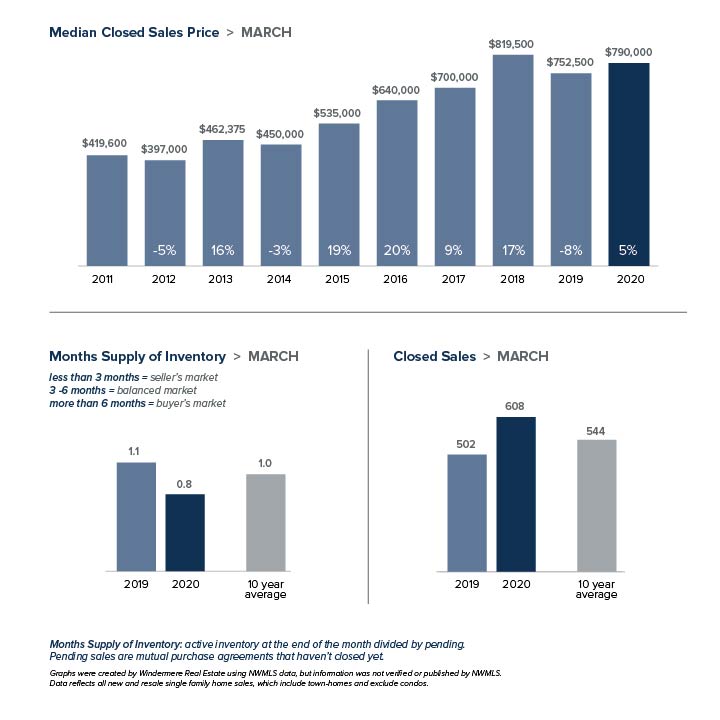

Local Market Update – April 2020

Windermere is focused on keeping our clients and our community safe and connected. We’re all in this together. Since the early days of COVID-19, our philosophy has been “Go slow and do no harm.” While real estate has been deemed an “essential” business, we have adopted guidelines that prioritize everyone’s safety and wellness.

Like everything else in our world, real estate is not business as usual. While market statistics certainly aren’t our focus at this time, we’ve opted to include our usual monthly report for those who may be interested. A few key points:

- The monthly statistics are based on closed sales. Since closing generally takes 30 days, the statistics for March are mostly reflective of contracts signed in February, a time period largely untouched by COVID-19. The market is different today.

- We expect that inventory and sales will decline in April and May as a result of the governor’s Stay Home order.

- Despite the effects of COVID-19, the market in March was hot through mid-month. It remains to be seen if that indicates the strong market will return once the Stay Home order is lifted, or if economic changes will soften demand.

Every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

Stay healthy and be safe. We’ll get through this together.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link