The Local Real Estate Market is Slowly Warming

Despite moments of snow in Western Washington, the local real estate market is slowly warming, as new opportunities arise for both home buyers and sellers. Lower mortgage rates are welcome news for buyers, and low inventory means sellers are starting the year with minimal competition.

King County continues to see residential price gains, with last month’s median sold price of $849,950 up from $825,000 a year ago. Condo prices also rose, up 15% from $465,000 in December 2022 to $537,000 last month. King County is also experiencing a reduced supply of available single-family homes. At the end of last month, inventory stood at 1.3 months, down from 1.6 months at the end of November and 2.0 months a year prior.

In a slightly different dynamic, Seattle experienced a decrease in both inventory and home prices last month. The median residential sold price was down from $879,975 in December 2022 to $850,000 last month. And December ended with 1.7 months of inventory, down from 1.9 months the previous month. While 16% of homes sold above list price in December, that was significantly lower than November, when 29% sold above asking. Seattle condo prices rose year-over-year, from $512,500 in December 2022 to $585,000 last month, with supply dropping 22 percent.

Following a modest decline in November, the Eastside rallied with an 11% bump in the median residential sold price, up from $1,400,000 last year to $1,440,000 last month. Further proof of a warming Eastside market: residential inventory is less than half of what it was last year, down from 2.5 months at the end of 2022 to just 1.2 months at the end of 2023. Mirroring the residential market, Eastside condominiums experienced a healthy 12% price increase last month, up from a median of $565,000 a year ago to $630,000.

Snohomish County was an interesting tangle of contradicting sales data. Median residential sold prices saw a slight year-over-year decrease last month, down from $700,000 to $684,995. This price decrease occurred despite a dramatic drop in inventory. The supply of Snohomish County single-family homes stood at just 0.8 months at the end of December, down from 1.8 months the year prior. Of the four areas reported in this market update, Snohomish County saw the lowest percentage of sold homes that had experienced a price reduction, at 41%, perhaps a reflection of the drastically reduced supply. Another possible outcome of the limited supply of single-family homes: the median sold price for Snohomish County condos jumped 11% year over year, from $469,950 in December 2022 to $523,500 last month.

As we move further into the new year, buyers remain hopeful that interest rates will continue to drop. The inventory of homes on the market has declined from a year ago in most markets, prompting price gains during what’s normally a slower time of year. Overall, the regional condo market has seen sustained activity, with unit sales experiencing only a modest decrease in the face of lower inventory and higher prices.

With regional submarkets exhibiting varying dynamics, it’s more important than ever for buyers and sellers to have a knowledgeable expert at their side. So connect with your Windermere broker to co-create a strategy that’s best for your buying or selling journey.

View the full report at getthewreport.com

Eastside Real Estate Offers Growth and Challenges

The Eastside is a hotspot for tech companies, including Google, Amazon, Microsoft and Facebook. With these companies’ expanding presence across Kirkland, Bellevue and Redmond come new opportunities for growth and development, but also new challenges.

At a recent Eastside Real Estate Symposium hosted by the Bellevue Chamber of Commerce, local developers and major employers met to discuss the future of commercial and residential real estate across Eastside municipalities.

One of the area’s major challenges is the growing need for residential real estate. The Eastside’s many anticipated new jobs are bringing massive development of commercial space, with 5.9 million square feet of commercial space under construction, and 9.1 million square feet to come online in the next decade. But housing on the Eastside is tight. Added jobs, amenities and transit – like the Eastlink light rail coming in 2021 – are enhancing the appeal of Eastside living for residents, but can there be enough new housing to match this demand?

To meet the growing need for housing in the area, several developers called for new multi-family residential projects, asking Eastside cities to reevaluate their zoning policies and streamline the construction and approval process to allow for more projects.

But while more multi-family developments could help to house an increasing Eastside population, representatives from Microsoft Philanthropies and Amazon’s external affairs office cited the need to ensure that housing remains affordable for the whole breadth of incomes in the area. On the Eastside, the median income is $100,000 a year, but developers need to consider that high-rise housing units are not always affordable. By working to ensure affordable housing for all through rent-restricted units, developers can prevent residents from becoming rent-burdened by their housing.

Another factor to consider with increased residential projects is parking. Some developers are asking the city of Bellevue to reexamine its land-use policies regarding parking ratios and parking minimums. Adding parking increases the cost of new development – passed along in the form of higher rents or prices. With robust public transit and the Light Rail, it’s likely that some residents and commuters may not have need for parking in the area.

As for the hospitality sector, industry leaders are aiming to entice more in-state travelers to the area while they wait for interstate and international travel to resume. To that end, the restaurant and hospitality sector is short by about 90,000 workers in the area. If they can find the workers to support further economic reopening, then Bellevue could see pre-pandemic lodging levels by 2023 — about a year ahead of Seattle.

This article was originally posted on 425Business by John Stearns and on GettheWReport.com

Local Market Update – June 2021

May was a record-breaking month for the real estate market. Inventory hit all-time lows, and home prices reached record highs. With the supply of homes so tight, this sizzling seller’s market is expected to continue throughout the summer.

High demand hammered inventory in May. While the number of new listings increased, homes sold within days, leaving the market with just a few weeks of available inventory. There were 43% fewer homes on the market in King County at the end of May as compared to a year ago. The supply of homes was particularly dire on the Eastside where inventory was down 71%, leaving just 239 single-family homes for sale across the entire area, which stretches from Issaquah to Woodinville. Snohomish County saw the same trend, with inventory down 60% year-over-year. With the local economy remaining strong and population continuing to grow, don’t expect demand to slow down any time soon.

With inventory so scarce, it was yet another record-breaking month for home prices. The median price of a single-family home in King County last month jumped 29% to an all-time high of $869,975. Home prices in Seattle soared 20% to a record $919,000. The Eastside posted a median price of $1,298,475, down slightly from its all-time high, but soaring 37% from a year ago. Slim supply and high demand resulted in 78% of homes on the Eastside selling for over the list price.

A 62% jump in pending condo sales in King County indicates that some buyers are opting for a more affordable home option. At a median price of $459,000, condos look like a relative bargain when compared to single-family homes. Snohomish County home values rocketed up as well. With some of the tightest inventory in the region, home prices there shot up 35% to a record $697,000.

It’s a challenging market for buyers, and it looks like it will continue to be that way for quite some time. Now more than ever, you need a broker who can help you set your priorities, strategize your options and negotiate successfully on your behalf. And sellers need someone who really understands this fast-changing market and who can create a plan to get you the greatest return on your investment.

The charts below provide a brief overview of market activity. Every Monday, Windermere Chief Economist Matthew Gardner provides an update on the US economy and housing market. You can get Matthew’s latest update here. If you are interested in more information, your broker can provide you with a detailed analysis of your specific area.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GettheWReport.com

Historic Building in St. Edwards Park Rebuilt as a $57M Hotel

Overlooking the shores of Lake Washington, the seminary at St. Edward State Park has long been awaiting the right developer to revive the historic building. After 44 years sitting vacant, the former holy site has been redesigned as a sleek, $57-million-dollar hotel — the most expensive hotel in the state.

Originally, the building was a seminary that educated young priests for 44 years before being sold to the state. Since then, the property — which features Romanesque Revival architecture across its 90,000 square feet — has been viewed as both an opportunity and too much of a burden for most developers to handle.

Now, the former seminary has been dubbed The Lodge at St. Edward State Park and has reopened to guests, complete with comfortable rooms, a gourmet restaurant, luxury spa, two bars and 9,000 feet of event space. While much of the historic charm has been lovingly preserved, the rooms did require a major modification: each of the 84 guest rooms is actually composed of two of the former dorm rooms, allowing for a more modern and comfortable experience for guests.

Throughout the hotel, historic features have been preserved, such as the 90-year-old façade and an original clock in the former great hall. Pictures of the seminary’s original inhabitants adorn the walls, even while modern décor offers style and a sense of ease to guests.

As part of his 62-year lease with the city, owner and developer Kevin Daniels purchased an additional 10 acres of undeveloped land to add to the park, increasing the size of the park which already offered guests access to Lake Washington shoreline and miles of hiking and biking trails.

For those looking to book a weekend away or even an extended stay, the nightly rate starts around $300 — the same cost as a year of tuition for students at the old seminary.

Photo courtesy of The Lodge at St. Edward.

This article was originally posted on Seattle Met by Allison Williams and GettheWReport.com

Local Market Update – May 2021

A sizeable increase in new listings in April offered some good news for buyers, but it was matched by an even greater increase in sales. With supplies depleted, and homes being snapped up within days, nearly every area saw double-digit price gains. The current forecast as we head towards summer: the market remains as hot as ever.

Despite the influx of new listings, inventory in the region remains one of the tightest in the country. At the end of the month there were 43% fewer homes on the market in King County than there were a year ago. Snohomish County had 49% less inventory, and has just 519 single-family homes for sale in the entire county. There were only 309 homes for sale on the Eastside, which stretches from Renton to Woodinville. Demand is so outstripping supply that 95% of the homes that sold last month on the Eastside sold within two weeks. In Seattle that number was 84%.

Home prices hit record highs in April, with nearly every area seeing double-digit price increases. The median price of a single-family home in King County last month was $830,000. Snohomish County’s median price soared to $675,000. Seattle’s median home price hit $875,000. All were new records. At $1.3 million, the median price on the Eastside was down slightly from its all-time high in March, but up a whopping 39% from the same time last year. In another show of the strength of the market, 82% of homes on the Eastside sold for over the list price. That compares with 60% of homes in Seattle. The Seattle market remains strong, however price appreciation there has slowed relative to other areas of King County and inventory has crept up. Condos present one bright spot for buyers. Price growth has been slower and inventory has been higher than for single-family homes. The $460,000 median price for a condo in King County is 45% less than the median price of a single-family home there.

Needless to say, this is a challenging market for buyers. With multiple offers and escalation clauses the norm, it’s critical to work with your broker on a plan to consider all possible scenarios when looking to buy a home. If you’re thinking about selling, it’s an ideal time to get a maximum return on your property before the prospect of rising interest rates starts to moderate the market.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GettheWReport.com

Google Continues to Invest in Kirkland

With the recent news that Seattle is the national leader in big tech office leases, it’s no wonder that Kirkland continues to be a prime spot for investment from Google.

Google recently announced that it plans to invest more than $7 billion in offices and data centers around the U.S., including the continuing construction of campuses in Kirkland and Seattle. The end result of these investments will be more than 10,000 new full-time Google jobs across the country.

Google has had a presence in Western Washington since 2011, and currently has about 6,300 employees in the region. The plan is for the tech company to continue the construction of two new campuses in Kirkland, in addition to its current 375,000-square-foot campus.

With the first new project in Kirkland, appropriately called the Kirkland Urban East campus, Google will add 760,000 square feet of office space, spread across four new buildings. This project is well underway, with the North building already completed and construction started on the South and Central buildings.

The company’s new project in the city is on the site of the former Lee Johnson Chevrolet dealership. Google finalized the purchase and sale agreement in November 2020, and the project is still in the early stages. The deal will likely close in stages over the next several years as Google finalizes its plans for the site.

Seattle is also benefitting from ongoing investment from Google. The company continues to work on Block 38, which is a 330,000-square-foot building located on the corner of Westlake Avenue and Mercer Street. This project is an extension of Google’s South Lake Union campus, which will span a total of five buildings and encompass 900,000 square feet of office space.

Among the news of Google’s upcoming projects, the company also released its 2020 Economic Impact Report. The report indicated that Google provided $17.3 billion in economic activity for 52,800 Washington businesses. Additionally, more than 398,000 Washington businesses connected with customers through Google searches last year.

This article was originally posted on 425Business by John Stearns and GettheWReport.com

The Gardner Report – Q1 2021

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact us here at Ali Mills Group!

REGIONAL ECONOMIC OVERVIEW

In the summer and fall of 2020, Western Washington regained some of the jobs lost due to COVID-19, but employment levels in the region have been in a holding pattern ever since. As of February, the region had recovered 132,000 of the 297,000 jobs that were lost, but that still leaves the area down by 165,000 positions. Given the announcement that several counties may have to roll back to phase 2 of reopening, I would not be surprised to see businesses hold off on plans to add to their payrolls until the picture becomes clearer. Even with this “pause” in the job recovery, the region’s unemployment rate ticked down to 6.1% from the December rate of 6.4% (re-benchmarking in 2020 showed the December rate was higher than the originally reported 5.5%). The lowest rate was in King County (5.3%) and the highest rate was in Grays Harbor County, which registered at 9.2%. Despite the adjustment to the 2020 numbers, my forecast still calls for employment levels to increase as we move through the year, though the recovery will be slower in areas where COVID-19 infection rates remain elevated.

WESTERN WASHINGTON HOME SALES

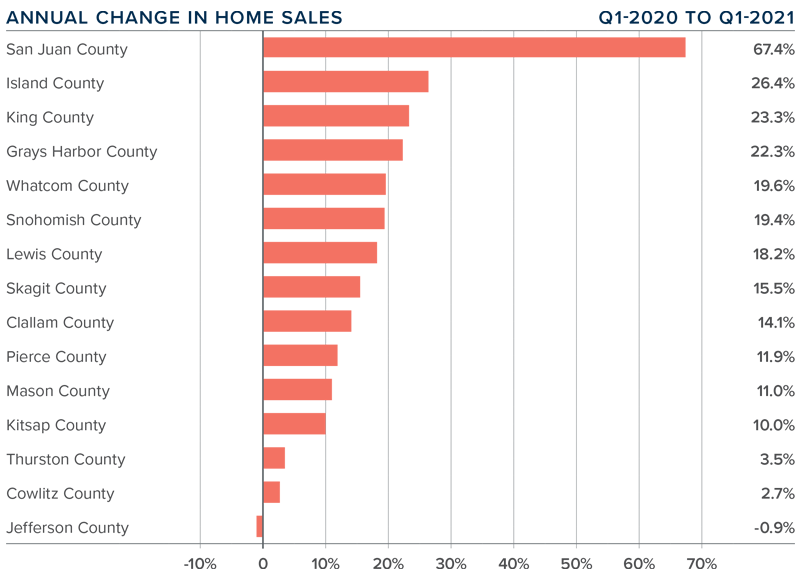

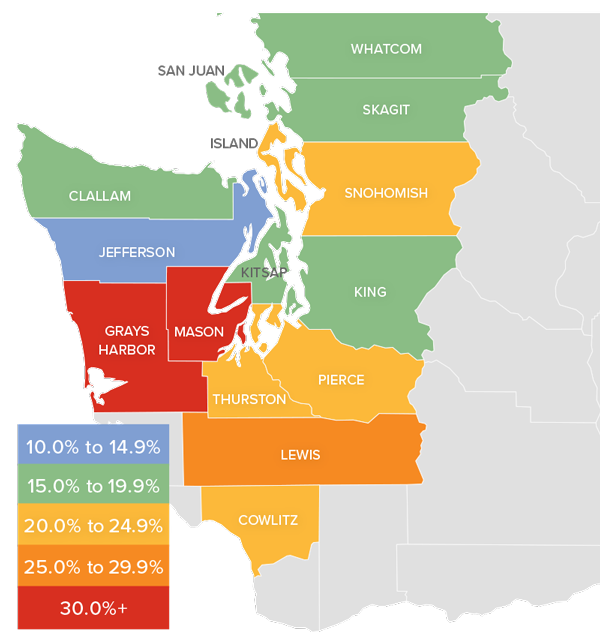

❱ Sales in the first quarter were impressive, with 15,893 home sales. This is an increase of 17.5% from the same period in 2020, but 32% lower than in the final quarter of last year—a function of low levels of inventory.

❱ Listing activity continues to be well below normal levels, with total available inventory 40.7% lower than a year ago, and 35.5% lower than in the fourth quarter of 2020.

❱ Sales rose in all counties other than Jefferson, though the drop there was only one unit. There were significant increases in almost every other county, but sales growth was more muted in Cowlitz and Thurston counties. San Juan County again led the way, likely due to ongoing interest from second-home buyers.

❱ The ratio of pending sales (demand) to active listings (supply) shows how competitive the market is. Western Washington is showing pendings outpacing new listings by a factor of almost six to one. The housing market is as tight now as I have ever seen it.

WESTERN WASHINGTON HOME PRICES

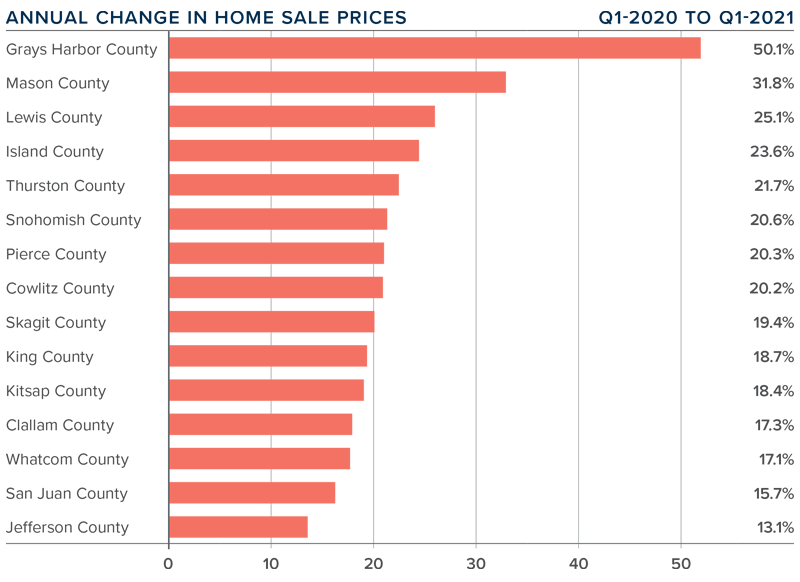

❱ Home price growth in Western Washington continues to trend well above the long-term average, with prices 21.3% higher than a year ago. The average home sale price was $635,079.

❱ Compared to the same period a year ago, price growth was strongest in Grays Harbor and Mason counties, but all markets saw double-digit price growth compared to a year ago.

❱ Home prices were also 2.9% higher than in the final quarter of 2020, which was good to see given that 30-year mortgage rates rose .4% in the quarter.

❱ I expect to see mortgage rates continue to trend higher as we move through the year, but they will remain significantly lower than the long-term average. Any increase in rates can act as a headwind to home-price growth, but excessive demand will likely cause prices to continue to rise.

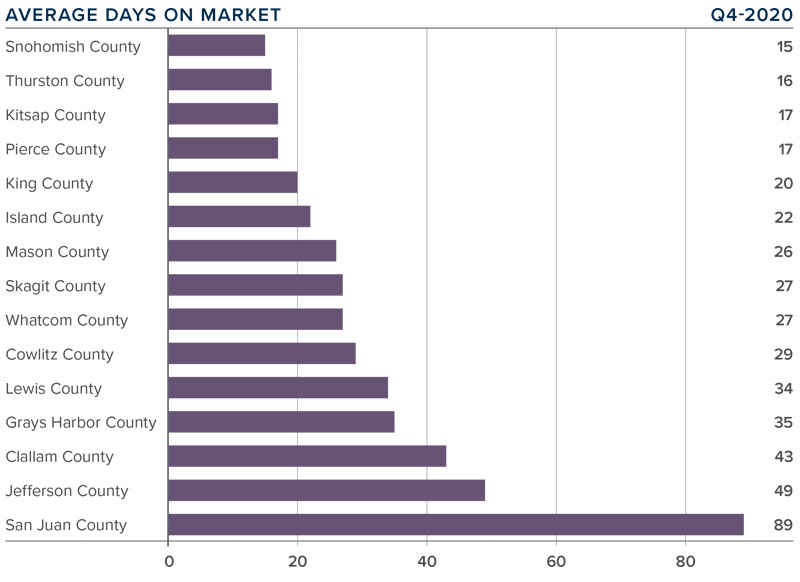

DAYS ON MARKET

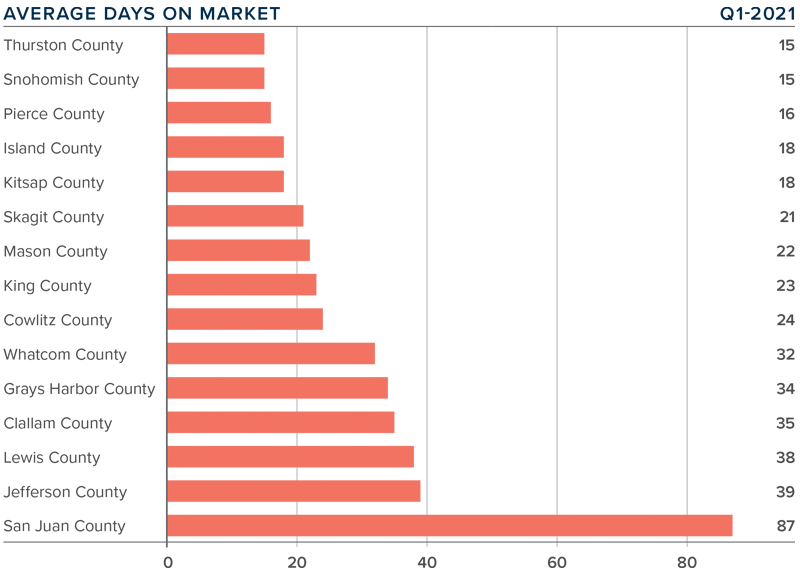

❱ The market in early 2021 continued to show far more demand than supply, which pushed the average time it took to sell a home down 25 days compared to a year ago. It took 2 fewer days to sell a home than it did in the final quarter of 2020.

❱ Snohomish and Thurston counties were the tightest markets in Western Washington, with homes taking an average of only 15 days to sell. The greatest drop in market time was in San Juan County, where it took 52 fewer days to sell a home than it did a year ago.

❱ Across the region, it took an average of only 29 days to sell a home in the quarter. All counties saw market time decrease from the first quarter of 2020.

❱ Very significant demand, in concert with woefully low levels of supply, continues to make the region’s housing market very competitive. This will continue to be a frustration for buyers.

CONCLUSIONS

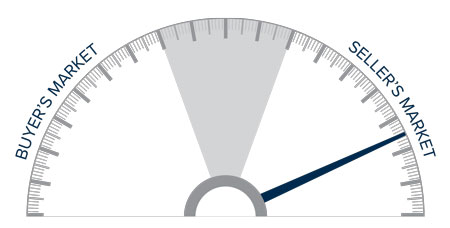

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Demand is very strong and, even in the face of rising mortgage rates, buyers are still out in force. With supply still lagging significantly, it staunchly remains a seller’s market. As such, I am moving the needle even further in their favor.

As I mentioned in last quarter’s Gardner Report, 2021 will likely see more homeowners make the choice to sell and move if they’re allowed to continue working remotely. On the one hand, this is good for buyers because it means more listings to choose from. However, if those sellers move away from the more expensive core markets into areas where housing is cheaper, it could lead to increased competition and affordability issues for the local buyers in those markets.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com blog

Local Market Update – April 2021

Despite a bump in new listings the supply of homes still can’t keep up with the demand. The result? Multiple offers, escalation clauses, and record-breaking prices. If you’re considering selling your home, you’d be hard pressed to find a more lucrative market than what we have today.

March marked the first post-COVID/pre-COVID comparison, and the results were dramatic.

The drop in the number of listings was profound. In King County there were 54% fewer single-family homes on the market at the end of March than the same time a year ago. The Eastside had 68% fewer listings. There were just 216 homes for sale on the Eastside, which stretches from Issaquah to Woodinville. Extensive new investments there, including Amazon’s plan to add 25,000 jobs in Bellevue, will only increase demand for housing. North King County, which includes Richmond Beach and Lake Forest Park had just 26 homes for sale. In Seattle, the 498 listings there represents a drop of 18% from a year ago. Despite the comparatively greater number of listings, Seattle still has only two weeks of available inventory. The situation was even more dire in Snohomish County. With the number of homes for sale down 68%, the county has just one week of inventory.

So why is inventory so low? The pandemic certainly has played a part. People now working from home have bought up properties with more space in more desirable locations. Nervousness and uncertainty about COVID compelled many would-be sellers to postpone putting their home on the market. Downsizers who may have moved into assisted living or nursing homes are staying in place instead. But there are other factors as well.

For more than a decade, less new construction has been built relative to historical averages, particularly in the suburbs. Interest rates have also been a factor. Windermere Chief Economist Matthew Gardner noted, “I think a lot of the urgency from buyers is due to rising mortgage rates and the fear that rates are very unlikely to drop again as we move through the year, which is a safe assumption to make.” Homeowners who refinanced when rates were at record lows are staying in their homes longer, keeping more inventory off the market. And those same low interest rates have compelled many homeowners who bought a new home not to sell their previous one, but to keep it as a rental property.

While the number of listings tanked, the number of sales skyrocketed. That’s the recipe for soaring home prices. Housing prices here have been growing at the second-fastest rate in the nation for a full year. Nearly every area of King County saw double-digit price increases, with the exception of Seattle. In King County the median price for a single-family home in March was a record-high $825,000, up 15% from a year ago and an increase of 10% from February. The median home price topped $1 million for every city on the Eastside, where the overall median price surged 30% to $1,350,000, the highest median price ever recorded for the area. Seattle homes prices were also record-breaking, rising 4% to $825,000. Snohomish County prices set yet another all-time high as the median home price jumped 22% to $640,000.

The appeal of our area just keeps growing. For the second time, Washington took the No. 1 spot in the U.S. News Best States ranking – the first state to earn the top ranking twice in a row. The bottom line: the local real estate market is extremely competitive, and it shows no signs of slowing down. Successfully navigating today’s market takes a strong plan. Your broker can work with you to determine the best strategies for your individual situation.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GettheWReport.com

Local Market Update – February 2021

This winter’s real estate market is looking more like a typical spring market. Sales were up, competition was fierce and prices continued to rise.

Lack of inventory still presents a huge issue. At the end of January there were only 1,055 single-family homes on the market in all of King County, 33% fewer than a year ago. If that wasn’t tight enough, Snohomish County had only 298 single-family homes for sale, 63% fewer than a year ago. Condos remain a bright spot for buyers frustrated by the frenzied market. January saw a nearly 50% increase in the number of condos for sale in King County. However, the increase in inventory didn’t translate into a drop in price. The median condo price was flat for the county, up 10% in Seattle and up 7% on the Eastside. Those looking for a relative bargain should consider Southwest and Southeast King County where the median condo prices were $254,275 and $269,900 respectively.

The large imbalance between supply and demand sent prices higher. Home prices here are climbing at the second-fastest rate in the nation. The median price of a single-family home in King County was $725,000, a 15% jump from a year ago. Seattle home prices increased 10% to $791,471. Inventory on the Eastside was down 58%, sending the median home price soaring 29% to $1.15 million. Snohomish County saw prices rise 18% to $599,990, well surpassing its previous high of $575,000.

While low interest rates take some of the sting out of rising prices, multiple offers over asking price have become the norm and are expected to continue. The easing of COVID restrictions may add yet more competition. Both King and Snohomish counties have moved into Phase 2 of the Healthy Washington plan, which allows open houses to resume with up to 10 people socially distanced.

All signs point to this strong seller’s market continuing for some time. The person who represents you as a buyer can make the difference in owning a home or not. Brokers are advising buyers to create a plan that prioritizes their wish list and sets realistic expectations in this hyper-competitive market.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Q4 2020 Western Washington Real Estate Market Update

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact me or another team member at Ali Mills Group!

REGIONAL ECONOMIC OVERVIEW

After the COVID-19-induced declines, employment levels in Western Washington continue to rebuild. Interestingly, the state re-benchmarked employment numbers, which showed that the region lost fewer jobs than originally reported. That said, regional employment is still 133,000 jobs lower than during the 2020 peak in February. The return of jobs will continue, but much depends on new COVID-19 infection rates and when the Governor can reopen sections of the economy that are still shut down. Unemployment levels also continue to improve. At the end of the quarter, the unemployment rate was a very respectable 5.5%, down from the peak rate of 16.6% in April. The rate varies across Western Washington, with a low of 4.3% in King County and a high of 9.6% in Grays Harbor County. My current forecast calls for employment levels to continue to improve as we move through the spring. More robust growth won’t happen until a vaccine becomes widely distributed, which is unlikely to happen before the summer.

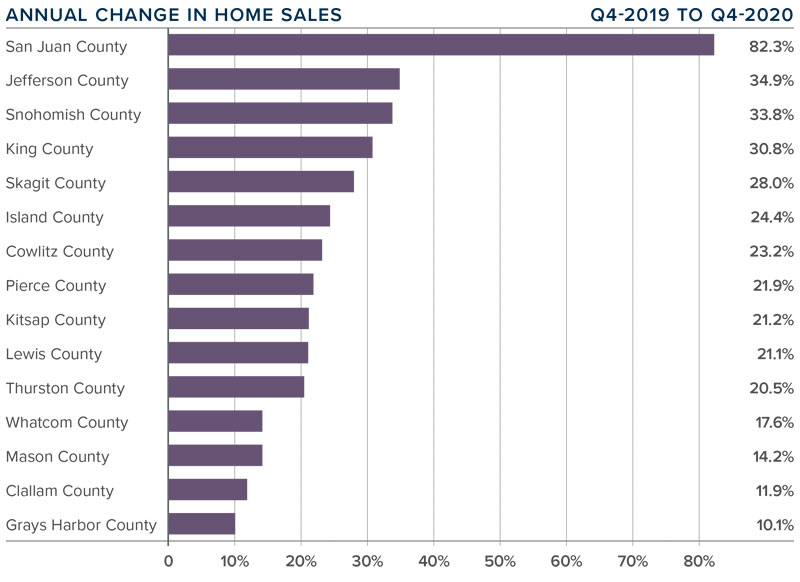

WESTERN WASHINGTON HOME SALES

❱ Sales continued to impress, with 23,357 transactions in the quarter. This was an increase of 26.6% from the same period in 2019, but 8.3% lower than in the third quarter of last year, likely due to seasonality.

❱ Listing activity remained very low, even given seasonality. Total available inventory was 37.3% lower than a year ago and 31.2% lower than in the third quarter of 2020.

❱ Sales rose in all counties, with San Juan County seeing the greatest increase. This makes me wonder if buyers are actively looking in more remote markets given ongoing COVID-19 related concerns.

❱ Pending sales—a good gauge of future closings—were 25% higher than a year ago but down 31% compared to the third quarter of 2020. This is unsurprising, given limited inventory and seasonal factors.

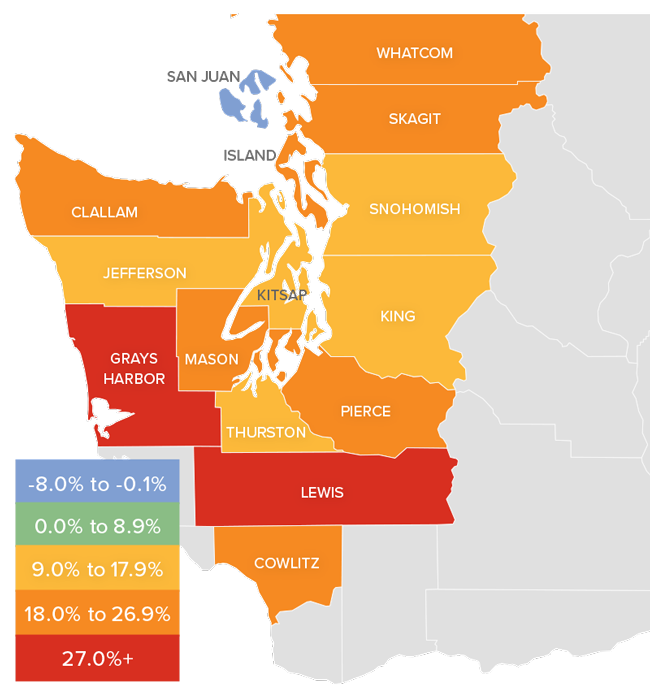

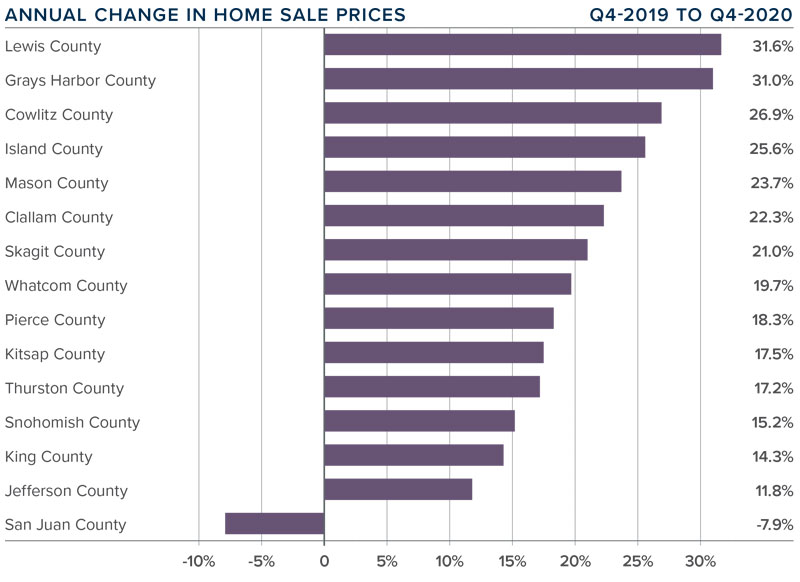

WESTERN WASHINGTON HOME PRICES

❱ Home price growth in Western Washington continued the trend of above-average appreciation. Prices were up 17.4% compared to a year ago, with an average sale price of $617,475.

❱ Year-over year price growth was strongest in Lewis and Grays Harbor counties. Home prices declined in San Juan County which is notoriously volatile because of its small size.

❱ It is interesting to note that home prices were only 1% higher than third quarter of 2020. Even as mortgage rates continued to drop during the quarter, price growth slowed, and we may well be hitting an affordability ceiling in some markets.

❱ Mortgage rates will stay competitive as we move through 2021, but I expect to see price growth moderate as we run into affordability issues, especially in the more expensive counties.

DAYS ON MARKET

❱ 2020 ended with a flourish as the average number of days it took to sell a home in the final quarter dropped by a very significant 16 days compared to a year ago.

❱ Snohomish County was again the tightest market in Western Washington, with homes taking an average of only 15 days to sell. The only county that saw the length of time it took to sell a home rise compared to the same period a year ago was small Jefferson County, but it was only an increase of four days.

❱ Across the region, it took an average of 31 days to sell a home in the quarter. It is also worth noting that, even as we entered the winter months, it took an average of five fewer days to sell a home than in the third quarter of last year.

❱ The takeaway here is that demand clearly remains strong, and competition for the few homes available to buy continues to push days on market lower.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Demand has clearly not been impacted by COVID-19, mortgage rates are still very favorable, and limited supply is causing the region’s housing market to remain incredibly active. Because of these conditions, I am moving the needle even further in favor of sellers.

2021 is likely to lead more homeowners to choose to move if they can work from home, which will continue to drive sales growth and should also lead to more inventory. That said, affordability concerns in markets close to Western Washington’s job centers, in combination with modestly rising mortgage rates, should slow the rapid home price appreciation we have seen for several years. I, for one, think that is a good thing.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link