13 Appliance Tips & Hacks for Household Chores

Modern home appliances make our lives so much easier: They tackle dreaded household chores, saving us time and effort. There are lots of ways to use them, however, that you may not have thought of before. Here are 13 little-known tricks for getting more than your money’s worth from your appliances.

- Sanitize small toys and more. Use your dishwasher to wash and sanitize teething rings, small plastic toys, mouth guards, and even baseball caps. Place items on the top rack and run the dishwasher as usual with detergent (without any dirty dishes). Put smaller items in a small mesh laundry bag so that they don’t move around.

- Clean ceiling fixtures. At least once or twice a year, remove and clean your glass ceiling fixtures and light covers in an empty dishwasher. Run the machine on the normal cycle.

- Eliminate wrinkles from clothing. To smooth out wrinkled clothes or linens left too long in the dryer, toss a damp, lint-free cloth in with them. Run the load on the lowest setting for 10 to 15 minutes. Newer dryers also feature a steam setting that removes wrinkles and refreshes clothing between wears.

- Disinfect sponges and dishcloths. Kitchen sponges and dishcloths contain billions of germs. Clean and disinfect them daily by zapping them on high in the microwave for 2 minutes to kill germs.

- Freshen up your curtains. Vacuum heavy drapes with the upholstery attachment. Use the dusting brush attachment for lighter drapes. Wash sheer curtains in the washing machine on the delicate cycle, then hang them up while they’re damp to prevent wrinkles.

- Remove wax from fabric or carpet. To get rid of wax on a tablecloth, place it in your freezer until the wax is hard. Then put a flat paper bag over the wax and another under the fabric. Iron the top bag with a medium-hot iron until all the wax transfers to the bag. To remove wax from a carpet or rug, place an ice pack on the spot until the wax hardens. Shatter the wax and vacuum up the chips.

- Clean baseboards. Dusting baseboards can be a backbreaking chore. Use your vacuum cleaner and the dusting brush attachment to avoid having to bend down. Do the same to clean chair and table legs.

- Organize your fridge. Use the built-in features of your refrigerator to organize food by category. Designate certain shelves or areas for leftovers, preferably front and center, so you don’t forget they’re in there. Use special-purpose bins for their intended use: crispers for vegetables, deli trays for deli meats and cheeses, cold storage trays for meats. Newer models also feature convertible cooling zones to keep food fresh.

- Dust blinds. Extend the blinds fully and turn the slats to the closed position. Use the dusting brush attachment on your vacuum cleaner to clean the slats from top to bottom. Then open and reclose the slats in the opposite direction and repeat the process.

- Clean your microwave. The best time to clean your microwave is immediately after using it. Thanks to residual steam, all you have to do is wipe it out with a paper towel or damp sponge. To clean old messes, microwave 2 cups of water on high for 5 minutes. The steam will soften cooked-on spills, which you can wipe off with a paper towel or cloth.

- Exterminate dust mites. Dust mites live off human and animal dander and other household dust particles. They thrive in sofas, carpets, and bedding. Use the upholstery attachment to vacuum your mattress and upholstered furniture regularly to minimize dust mites. Be sure to empty the canister in an outdoor trashcan.

- Groom your pet. After you’ve groomed your dog or cat, use the dusting brush attachment to clean up after. It’s an easy way to collect shedding fur, especially from carpetted areas or upholstery.

- Remove grime from shower liners. Wash plastic shower curtain liners in the washing machine with hot water and detergent on the regular cycle. Throw in a small bath towel to help “scrub” mildew and soap scum off the liner. Then rehang the liner and let it air-dry.

Have you found any unusual cleaning hacks for your appliances? Share in the comments below!

This post originally appeared on the Windermere.com Blog

Local Market Update – April 2020

Windermere is focused on keeping our clients and our community safe and connected. We’re all in this together. Since the early days of COVID-19, our philosophy has been “Go slow and do no harm.” While real estate has been deemed an “essential” business, we have adopted guidelines that prioritize everyone’s safety and wellness.

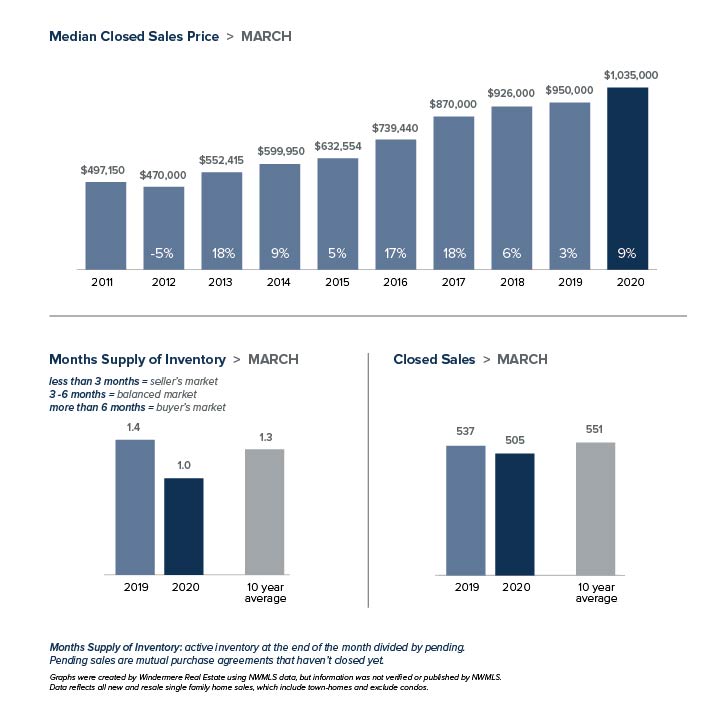

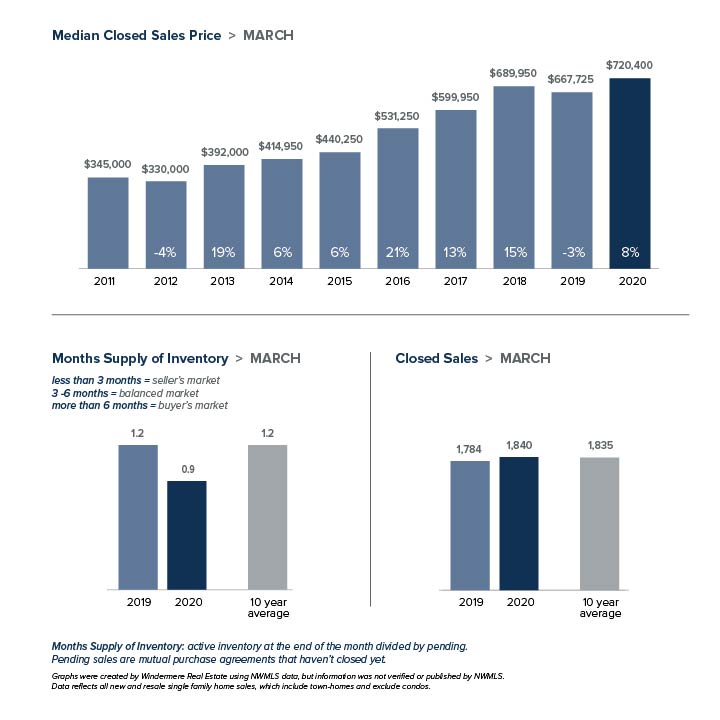

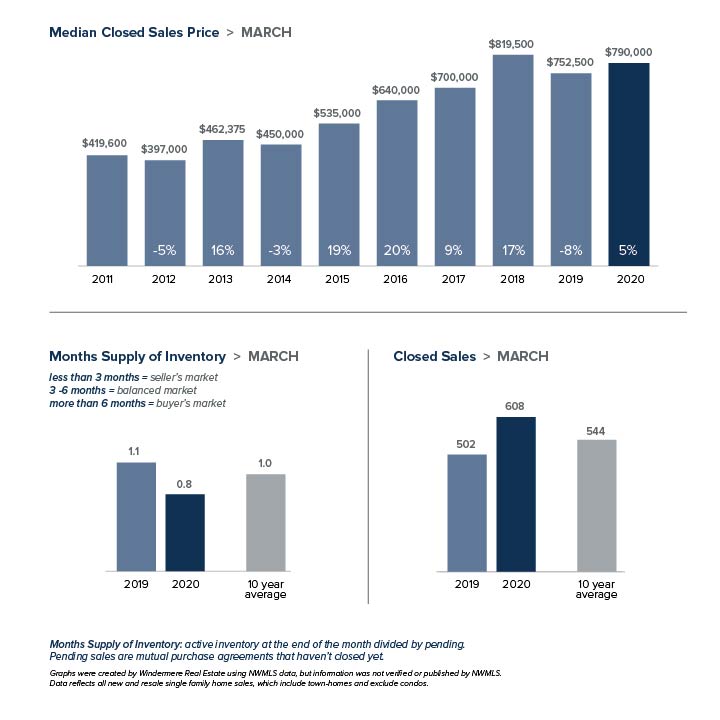

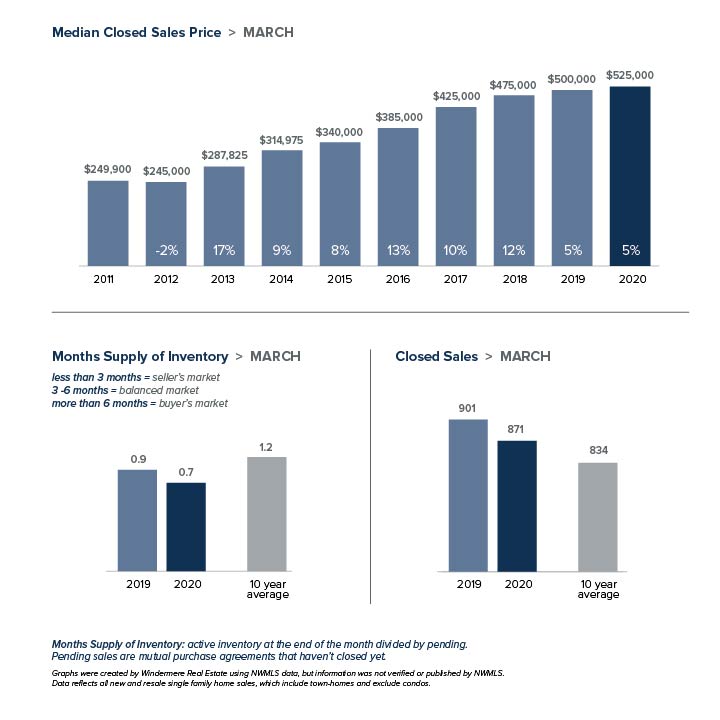

Like everything else in our world, real estate is not business as usual. While market statistics certainly aren’t our focus at this time, we’ve opted to include our usual monthly report for those who may be interested. A few key points:

- The monthly statistics are based on closed sales. Since closing generally takes 30 days, the statistics for March are mostly reflective of contracts signed in February, a time period largely untouched by COVID-19. The market is different today.

- We expect that inventory and sales will decline in April and May as a result of the governor’s Stay Home order.

- Despite the effects of COVID-19, the market in March was hot through mid-month. It remains to be seen if that indicates the strong market will return once the Stay Home order is lifted, or if economic changes will soften demand.

Every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

Stay healthy and be safe. We’ll get through this together.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

EMBRACE THE CHANGE

Can you believe it’s October already and Halloween is just around the corner? I love Fall (or Autumn as we call it in England!) for many reasons. October is my birthday month so what’s not to love about that. Then there’s the weather – I always have romantic hopes that there will be more crisp, cold and sunny days than dreary, rainy days.

What I love most about Fall is that it signifies change. The changing of the season, the changing of the weather, the turning back of the clocks. But there’s more to it than that. September is always our busiest month with the start of school, curriculum nights and the resuming of after school activities. So, come October, I feel we’ve all found our groove and life settles down before the Holidays – I think of it as the calm before the storm! Plus, both children have August and September birthdays so it’s a time of year when they just seem to grow up almost overnight. This year my daughter started Middle School and she’s become so much more mature in just a few short weeks. Just this morning she announced I didn’t need to walk her to the bus stop. It was bitter sweet – it was raining and only 7:15am – but I was saddened by the loss that I feel with her growing independence. My son has started 3rd grade – he’s now officially half way through his elementary school career, and I know I have just a few short years of boyhood to enjoy.

From a personal perspective, it’s at this time of year I begin to reflect back on the year. I review both my Vision Board and the Business Plan that I create in January which allows me to see not only what I’ve achieved for the year and the goals I’ve hit (or not!) but also how much life has evolved. This year, the change is more significant than in previous years. In January I challenged myself to lead a healthier lifestyle, to love and to laugh more and embrace what lay ahead held for my new family of three. I’m proud of all that has happened.

I also start planning for the year ahead. What do I want to achieve from a business perspective? Where shall we go on vacation? What personal goals shall I set myself? So far all I know is that 2019 will be the year I learn to Paddle Board and I’ll take a vacation somewhere with my parents and my brother’s family. The rest is yet to be figured out. And that’s ok. Change is what happens when you’re busy leading your life. It’s how you react to the change that counts.

Here’s to your positive changes.

Ali Tamblyn

P.S. The housing market has also experienced significant change in recent months. If you’d like to know more about the current market conditions or know anyone I can help with buying or selling a home, I’m always here to help!

THE RISKS AND PITFALLS OF USING STOCKS & SHARES TO FUND A REAL ESTATE TRANSACTION

Yesterday the stock market took a nose dive, dropping nearly 5% – one of the worst single day losses in history.

With no particular underlying reason for this volatile activity, for most of us it will have little impact, even if we have a stash of investments. The likelihood is we can ride out the losses and wait for it to regain its value. But what happens if you’re under contract to buy or sell a house, and the buyer is dependent on the sale of those assets to close on the home.? There’s a strong possibility that some the transaction could fail in such a situation.

Increasingly lenders are allowing buyers to use company shares as part of their asset/debt ratio to help increase their purchasing power. And with many Amazon and Microsoft employees who receive a healthy stock bonus every year, there are plenty of buyers in this area who do rely on those assets to fund the purchase of their house – either directly or indirectly.

Should you ever find yourself in this situation, I have two words of advice for both buyers and sellers.

- Buyers – Disclose, Disclose, Disclose! The purchase and sale agreement should specify that the closing of the transaction is dependent on the liquidation of assets and what those assets are. Also include a statement of value. Failure to do so means you don’t have a contingency in place should the value of those assets suddenly plummet overnight, even if you have a financing contingency for a loan of any sort. While some sellers may be understanding if you disclose once under contract, ultimately the seller has the right to refuse and terminate the contract. In such a hot market, where back up offers are common, is this a risk worth taking?

- Sellers –request that your buyers liquidate any such invested assets within three or five days of mutual acceptance. This should be included in the purchase and sale agreement, irrespective of how long the closing window is. Buyers, this may seem to put you at a disadvantage, but cash in the bank is always preferable to invested assets. Any appreciation you might stand to gain from those shares rising in value while you are in Escrow will be minimal compared to what you stand to lose should they drastically drop in value, and you don’t have the required cash to close on the home.

My final word of advice is for sellers working with cash buyers. While cash is great – it’s not always king. Be sure to have your realtor dig deep with the buyers agent to find out if they are really are all cash buyers, or if perhaps they are relying on the liquidation of other assets to come up with the required cash at closing. Proof of funds that reach, or better yet exceed, the value of the purchase is the best way to do this.

Don’t let the myths fool you into thinking you can’t buy

Buying a house can be scary – especially when you don’t know the facts.

If owning a home is one of your dreams, but you’ve convinced yourself you wouldn’t quality for financing, it could be time to think again. Here are the most common myths that prevent buyer’s from pursuing their home owning dreams.

Key takeaways:

Credit scores of 780 or above and 20% down payment are not key criteria. Here are the facts:

- 40% of millennials who purchased homes this year have put down less than 10%. FHA and VA loans require even less. And if either your or your partner have served in the military, you may qualify for a VA loan.

- 76.4% of loan applications were approved last month.

- The average credit score of approved loans was 724 in September.

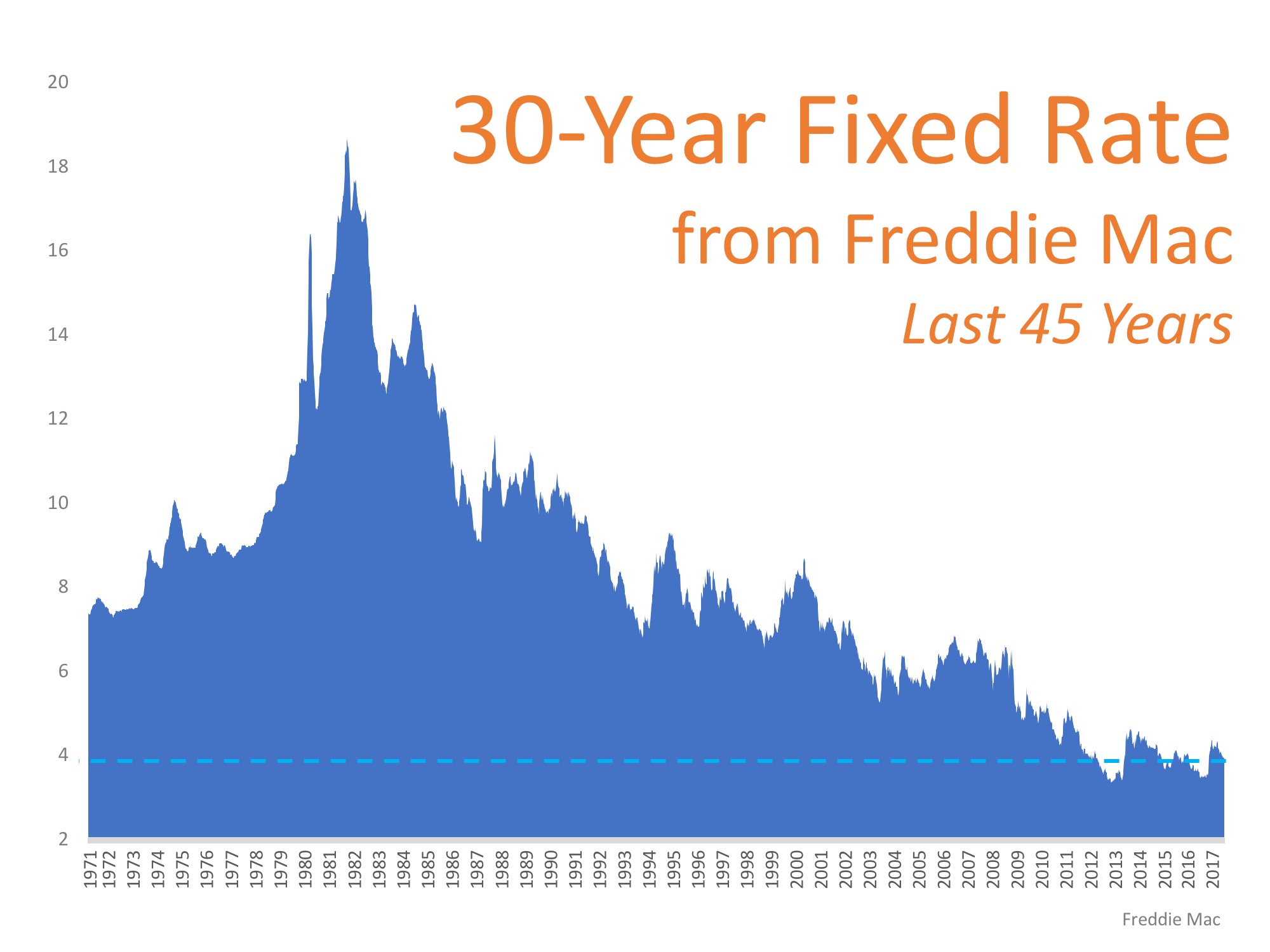

Be thankful you don’t have your parents interest rates

I don’t know about anyone else, but following last night’s Halloween festivities, it feels like there’s not enough coffee in the world to get me going this morning. Being British, Halloween has never been a big deal for me, but as they say ‘When in Rome’. After 10 years living stateside I have to confess it’s my least favorite celebration of the year – especially as a parent. My kids are just so overexcited for so long, there’s always costume drama, it’s a late night (always fun on a week night) and then there’s the candy hangover to deal with. To say I’m feeling sluggish today is an understatement.

But here’s a little Hump Day Trivia that certainly shocked me – and made me oh so grateful for today’s low interest rates.

It was about this time in 1981 that interest rates reached their all time high – of a shocking 18.65%. Today’s buyers balk at it going above 4%, having seen lows in the high 3’s for much of the year. Can you imagine 18%!! Here’s some numbers that will force you throw down your left over Milky Ways in horror!

It was about this time in 1981 that interest rates reached their all time high – of a shocking 18.65%. Today’s buyers balk at it going above 4%, having seen lows in the high 3’s for much of the year. Can you imagine 18%!! Here’s some numbers that will force you throw down your left over Milky Ways in horror!

Based on today’s median house price of $853,000, and a 20% down payment, you’d be paying $10,646 per month for your mortgage. And that’s not including taxes and insurance. Add those in, and monthly payments would add up to $11,446. Wow – that’s a number I can’t even comprehend. To put it into even greater perspective: Lenders only like to see mortgage payments of approximately one third of your total net monthly income, so we’d all need to be bringing home the bacon to the tune of over $30,000 per month. It’s just not going to happen!

So while there’s much of the 80’s I’m grateful for (Madonna, George Michael and The Eurythmics to name just some of my musical heros), I very happy that we’ve not seen the interest rates that came with the wonderful music and equally shocking fashions.

Fast forward to today: As I said interest rates are currently hovering around 4%. Economists are predicting that to hold steady in the short term, but are expected a rise to closer to 5% in 2018. This has the potential of slowing down the current double digit price growth we are experiencing – which could be a good thing.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.